“Regrets are idle; yet history is one long regret. Everything might have turned out so differently.”

– Charles Dudley Warner

Core Views:

- US: Positioned tactically with a bias for steepening and a preference for front-end longs

- Europe: Looking to enter steepening trades in core countries and remain tactical around Italy at current levels

- UK: Remain tactical, yet with yields having touched new lows we are looking for an entry point to implement curve steepening views

- FX: Tactical longs in BRL & NOK vs USD were stopped out; we now look for USD pullbacks to add to long positioning, predominantly versus EM and growth-sensitive DM FX

- Credit: Maintain a low spread duration with beta hedges; focus on single names having rotated away from smaller issuers; we remain focused on subordinated bank debt and 5-year IG bonds in USD and have pared our HY and hybrid exposure in EUR

“What are your deepest regrets?” This was a dinner table question posed during a recent New York investor trip of ours. “Personal or Professional?!” was the immediate retort, accompanied by a growing sense of uneasiness in the far corners of our limbic brain system. As we ruminated on how we might feel at the end of our lives, looking back at the decisions we had made along the way, we later had the opportunity to consider those decisions made by men and women 30 blocks or so downtown from where we dined.

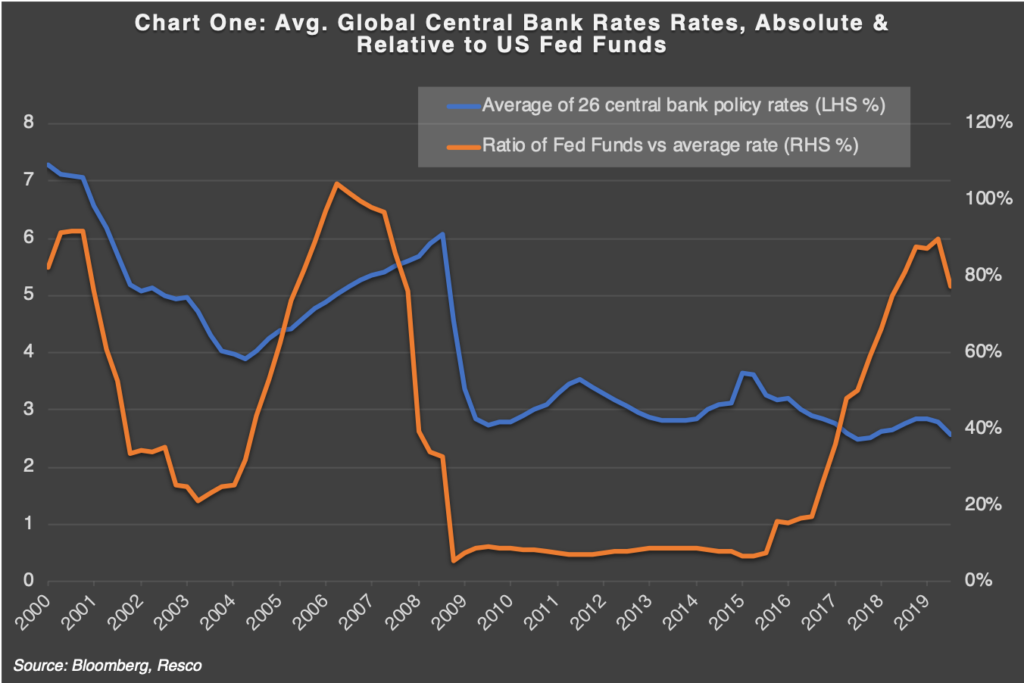

The next morning we passed through the financial district, finding ourselves outside one of the world’s most influential institutions: the Federal Reserve Bank of New York. Reflecting on our own regrets, we wondered whether policy makers might have any. It was not lost on us that trillions of US dollar QE reserves had been created through keystrokes behind the very walls in front of us, yet to little avail when measured purely by economic results. Recent repo turbulence has pulled yet more liquidity into the system, in turn bringing to a halt the Fed’s balance sheet shrinking for now. Globally, central banks have collectively cut rates more than 100 times so far in 2019, most of them outpacing the Fed’s two rate cuts and, in aggregate, fully reversing the tightening of 2018 (see Chart One).

The slowing global economy is presently entering a defining vortex where policy regrets are unavoidable, as traditional monetary levers are now rendered ineffective. The recently-publicised disagreements between policy makers of the ECB and FOMC are but a symbol of the conundrum of what constitutes optimal policy responses from here.

Speaking of conundrums, there is another that has grabbed the attention of the investing public concerning the discernible appetite for one of either equity or bond valuations to be crowned as having a meaningful ability to forecast the future economic reality from this juncture.

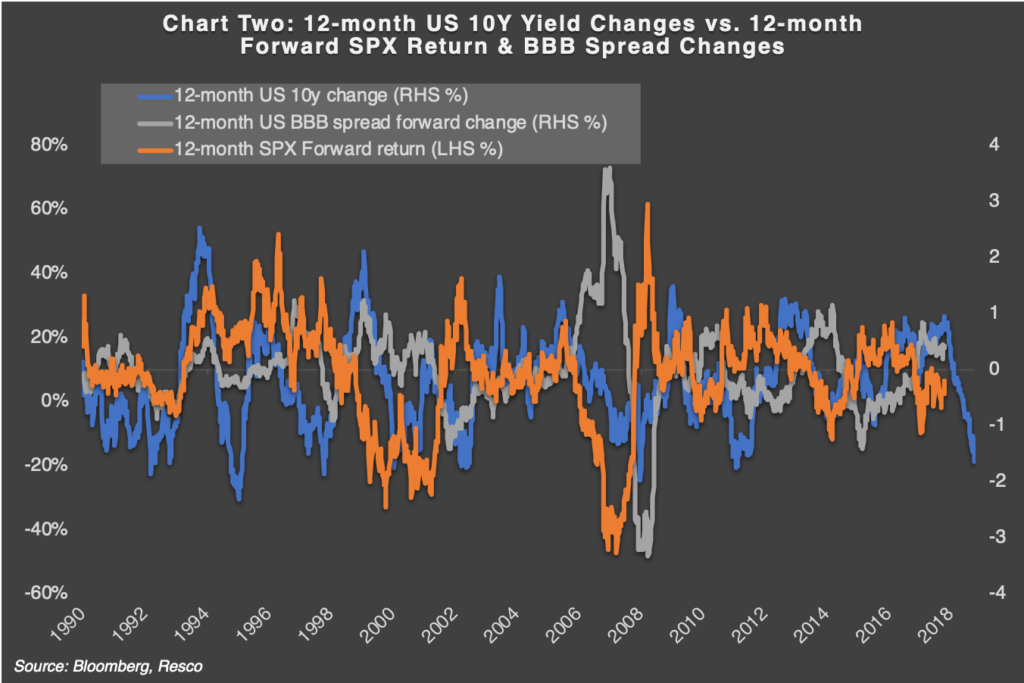

With US equities still near all-time highs and US government bond yields retracing towards the all-time lows, we hear many a market-watcher shouting, “They both can’t be right!” We caution that these markets are not necessarily signalling opposing views, as is widely and loudly touted, and that lower bond yields do not have to coincide with lower equity valuations, especially on a forward-looking basis (Chart Two). Given these two key markets appear critical in dictating the near-term sentiment and medium-term outlook for large swathes of the developed and liquid investable universe, acknowledging this interpretation liberates an investor’s belief system to objectively consider what comes next for each of these asset classes and the various other market segments looking on expectantly.

To avoid the confusion and disappointment that arrives when one’s macro view is correct, but securities and markets move counterintuitively due to structural flows, we suggest seeking out expressions that honour one’s view but manifest in more indirect market segments.

For example, in our current positioning for a theme of a weakening macro environment for risk, we concluded that both front-end (or “short-dated”) long positions and yield curve steepening trades are superior expressions to selling or shorting risk assets outright, given our expectation of a slowing (but not recessionary) environment. Similarly, the click-friendly cries to aggressively short credit markets outright can at times be deafening and, while one can always get lucky with timing, selecting idiosyncratic corporate stories to invest in alongside cash and risk-off credit hedges can ensure you stay in the game while you’re waiting for your ‘correct’ view on extended valuations in credit to be vindicated.

In summary, historical norms that have supported risk-parity techniques seem to be less reliable in the current environment. It is not a brand-new concept that ‘being right’ and losing as a result can happen (e.g., predicting that risk will rally in 2019 and selling bonds as part of that expression); however, this conundrum is particularly prevalent right now. Seeking out 10 indirect expressions of your dominant theme to replace your two or three concentrated bets can assist in avoiding the chance that you exhaust your entire risk budget before you have the opportunity to be rewarded for your correct view. You might not make the front page for the size of your bets, but your investors may well be rewarded with capital preservation and superior risk-adjusted returns over the longer term.

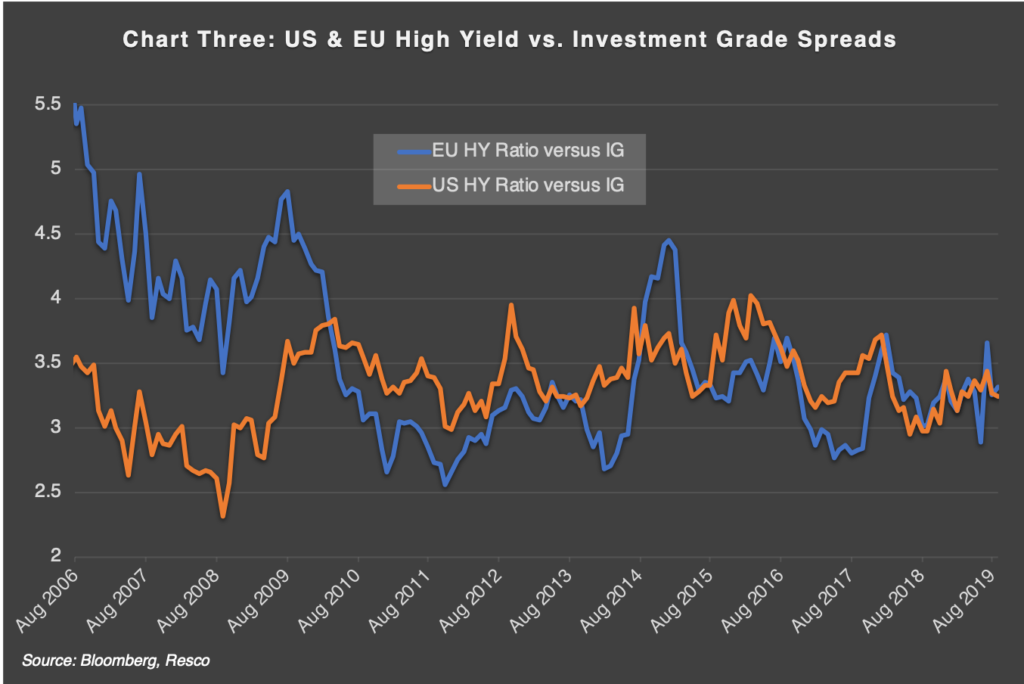

- The ratio of High Yield to IG spreads is at low, but far from extreme, levels. The US ratio low was pre-crisis, in the context of an overall higher government bond yield environment.

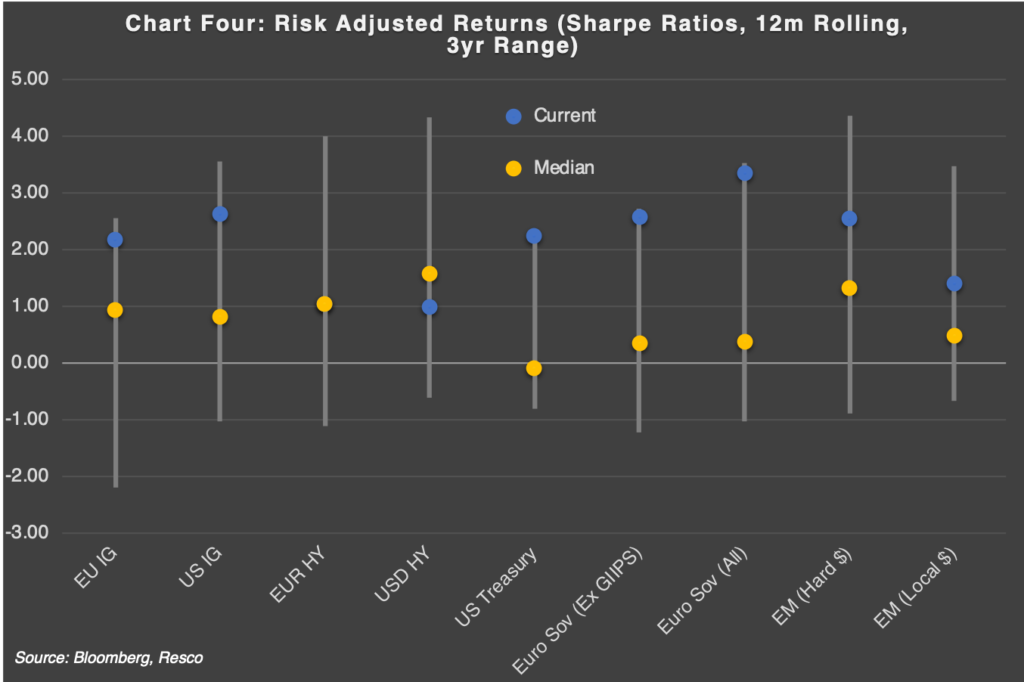

- Risk-adjusted returns sit above the three-year median for most segments, with USD and EUR government universes setting new three-year Sharpe highs

Summary:

- US data have deteriorated but are not recessionary, while inflation readings are rebounding. Extreme long bond positioning has corrected somewhat in the past few weeks, leaving us with the view that one should be more tactical on outright duration for the time being.

- The ECB is looking to ease aggressively, which we see as the platform for a more bearish set-up for core rates in the area, especially in the long end

- Government rates overall only offer protection from a recession scenario and/or aggressive cuts into a new negative rate paradigm

- US credit outperformed in September, led by the high-yield segment. Europe saw wider spreads across the quality spectrum, with issuance pressures weighing on secondary market performance. Fund outflows, sharply higher benchmark rates or meaningfully softer equities are needed to ignite a bout of material widening.

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team