As the big egos do battle over the right for new paradigms to emerge, we suggest remaining open to all possibilities.

“Will we go bankrupt? So far, the markets are in denial. There will come a moment when the bond investors will rebel. The United States is going to do a Wile E. Coyote run off a cliff, look down, and … poof “

– Paul Krugman, Berkeley, September 2003

Core Views

- MMT is here: big market implications once next downturn/crisis hits

- Reduced interest in risk-on positioning after recent rally

- Adopted tactical directional positioning in rates, amidst fall in volatility

- Strategic focus on curve trades in the US and Europe, with a focus on flatteners

- Short Italian debt and closing EM FX longs vs. USD

- Underlying caution on tight credit spreads, open to tactical single name exposure, negative on BBBs

- Preference for non-rated and EUR high yield credit, and lower duration (<5 years) to limit spread duration

- Additional tier 1 banks are standout on a relative basis, but now becoming fully-priced

Macro, by David Ric: Economic theories have all at some point been part of the compulsory syllabus for most investors, especially those managing macro and fixed income strategies. While it’s useful to adapt the available frameworks in order to understand the global macro system and its reflexive interaction with financial market behaviour, it is generally not advisable to dogmatically invest according to principles which have rational decision making and efficient markets as assumptions at their heart!

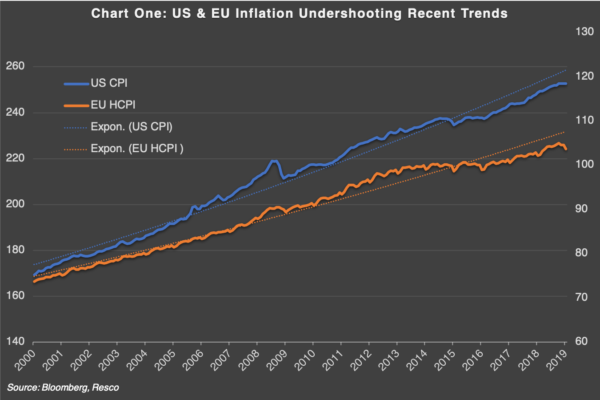

As our monthly commentary is written, we observe the 10-year anniversary of the S&P 500’s infamous intra-day low of 666. Numerous rounds of QE and a doubling of global debt levels have done little to overall yield levels or inflation. Why? After all, the multiplier effect should have expanded money supply to such an extent that inflation would logically rise. This did not happen. Consumer price inflation has, in fact, trailed central bank’s inflation targets for a while (See Chart One) and the Philips curve, well, is now flat.

A fixation on the stubbornness of inflation led me a decade ago to Modern Monetary Theory (MMT), the much-discussed new challenger to conventional economic thinking, which has recently taken financial and economic circles by storm. MMT’s descriptive nature around the operational realities of central banking in a fiat currency regime intrigued me. It seemed intuitive and obvious for thousands of years that the earth was in a fixed position and that the sun rotated around it. In a similar fashion it seemed obvious that central banks control money supply and therefore fine tune the economy by setting interest rates and fixing reserves which power bank lending. An increase in central bank money supply thereby leads to less buying power (via inflation). A government, in turn, needs to borrow money (issue debt) to facilitate a deficit, and ultimately grow its way out of its debt burden or risks fiscal insolvency.

A fixation on the stubbornness of inflation led me a decade ago to Modern Monetary Theory (MMT), the much-discussed new challenger to conventional economic thinking, which has recently taken financial and economic circles by storm. MMT’s descriptive nature around the operational realities of central banking in a fiat currency regime intrigued me. It seemed intuitive and obvious for thousands of years that the earth was in a fixed position and that the sun rotated around it. In a similar fashion it seemed obvious that central banks control money supply and therefore fine tune the economy by setting interest rates and fixing reserves which power bank lending. An increase in central bank money supply thereby leads to less buying power (via inflation). A government, in turn, needs to borrow money (issue debt) to facilitate a deficit, and ultimately grow its way out of its debt burden or risks fiscal insolvency.

My short conclusion is that the above is in fact not true. There is zero solvency risk for sovereign nations which have their own fiat currency and issue domestic debt.

Governments are not revenue constrained as previously thought and fiscal policy indeed helps balance economic output when required. Richard Koo’s excellent research on balance sheet recessions and sectoral balances supported many of those conclusions already during the financial and sovereign crisis. While not an immediate investable macro theme, we believe the current—and mostly political—discussion around fiscal spending, job guarantees and the role of MMT will shape future policy decisions with regime changing potential for financial markets. Meanwhile, price level targeting is again being discussed as new monetary policy tools are explored in order to lift inflation closer to trend (see Bernanke’s latest blog).

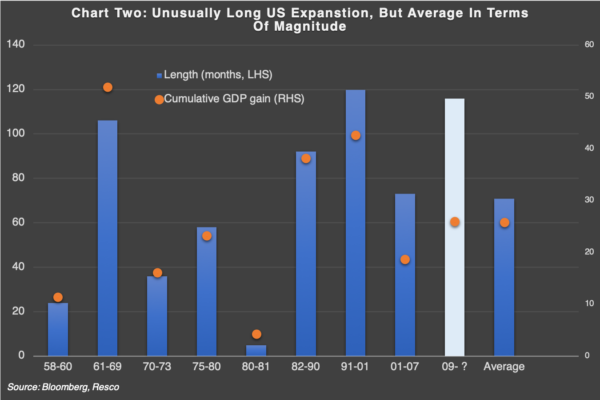

US citizens are living through one of the longest economic expansions on record (see chart 2). Fast forward to the next recession or crisis; how are we going to stimulate the economy? Quantitative easing (QE) & negative rates can do their best to maintain financial market stability, but how can we indeed lift nominal growth and induce an easing of policy which not only helps holders of financial assets but also works for all and can alleviate inequality issues?

Helicopter money, i.e., a more coordinated effort between fiscal and monetary authorities, seems inevitable. “QE for the people” would be a game changer on many levels. We can envisage a system by which bank reserves are created at a keystroke to periodically distribute bank credit to every adult member of the population, with set limits by which each distribution must be spent (to ward off the propensity to save). We do not need an economic model to gauge the impact on prices of such a policy!

Returning to the here and now, the dovish rhetoric of central bankers supports risk markets for the time being. While we acknowledge there is a window for “carry” investing to be in place, we are strategically less enthusiastic about risk assets and await better entry levels.

Returning to the here and now, the dovish rhetoric of central bankers supports risk markets for the time being. While we acknowledge there is a window for “carry” investing to be in place, we are strategically less enthusiastic about risk assets and await better entry levels.

We foresee the prospect of further rate hike normalisation by the Fed in the second half of this year and hence focus our strategies around the US front-end. The ECB is seemingly running out of options aside further forward guidance adjustment and TLTRO’s. The “Japanisation” of Europe, once dreaded, looks now the most likely outcome, albeit complicated by an imperfect and unbalanced intra-European situation.

We remain tactical in expressing directional rate positioning over the coming months, preferring yield curve strategies to express strategic views. We are shorting Italian bonds as we anticipate further political tensions and calls for fiscal expansion to weigh on peripheral risk sentiment. In an environment where global central banks turn dovish in tandem, the USD should remain well supported. We therefore close our EM FX longs but remain long JPY.

Macro positioning summary:

- Given the fall in rates volatility, we move our focus toward more tactical directional positioning over the coming months and prefer yield curve trades to express our medium-term views

- We continue to focus our macro themes and positions around the front-ends in the US and European bond market, while preferring Inflation-linked to nominal bonds

- We are shorting Italian bonds as we anticipate continued political tensions and calls for fiscal expansion to weigh on peripheral risk sentiment

- We are closing our USD short vs. selected EM currencies and remain long JPY vs. USD

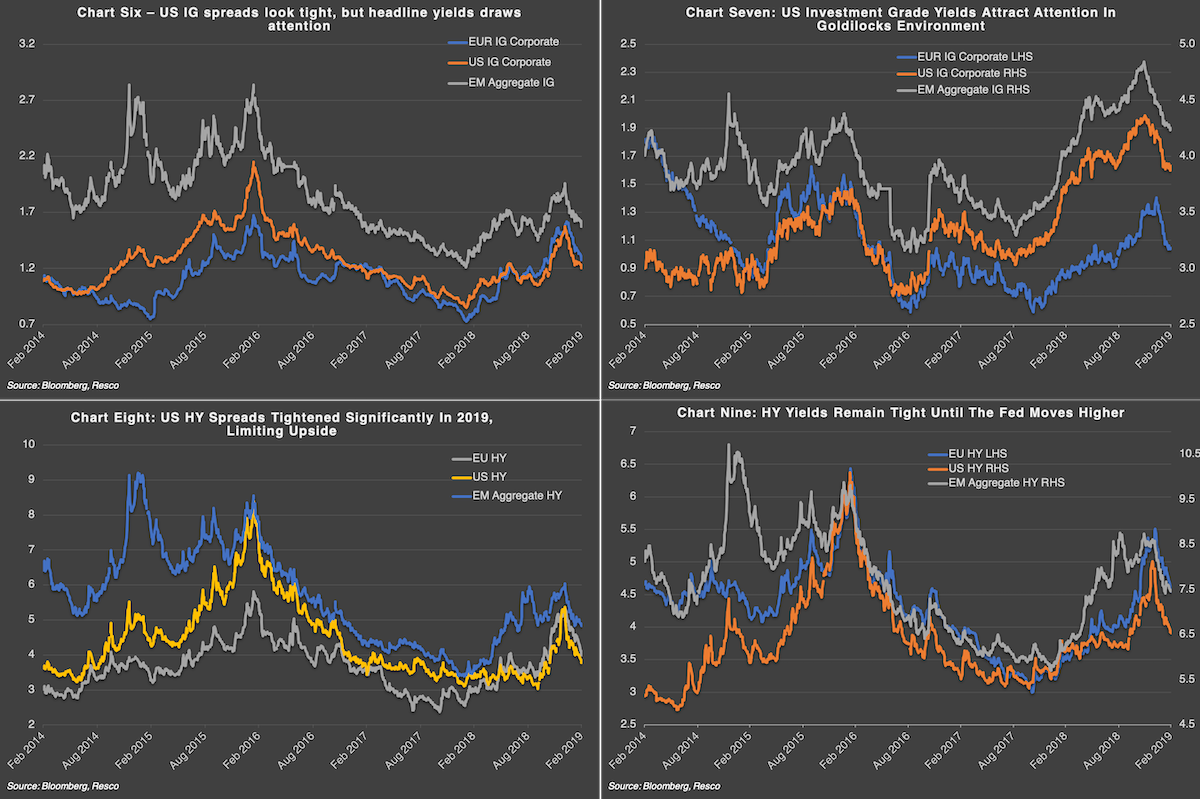

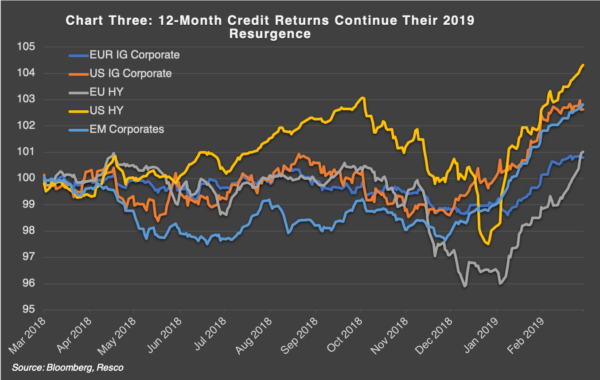

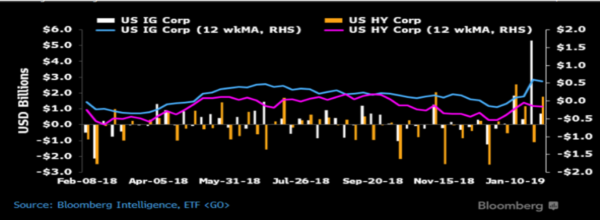

Credit, by Alex Eventon: The hype around a potential goldilocks configuration was lapped up by credit markets which gorged on primary and secondary markets in February. The primary market has come to life with numerous jumbo deals springing up, but alas even this could not ward off sizeable spread gains, namely in EUR and USD high yield, but also EUR Investment Grade, with 8 basis points of spread tightening for US investment grade.

Credit, by Alex Eventon: The hype around a potential goldilocks configuration was lapped up by credit markets which gorged on primary and secondary markets in February. The primary market has come to life with numerous jumbo deals springing up, but alas even this could not ward off sizeable spread gains, namely in EUR and USD high yield, but also EUR Investment Grade, with 8 basis points of spread tightening for US investment grade.

Monthly returns were spectacular: US high yield and EUR high yield returned 6.3% and 4.6% respectively, followed by European investment grade at 1.8% and US investment grade at 2.6%.

The swift retracement of late 2018 losses, and then some, puts us back in precarious territory. While we are still some way off the recent tights, spreads are now all the way back to October 2018 levels. The US high yield universe is 150bps tighter than year end. For high yield overall, spreads are perched at 480bps (a yield to worst of 6.5%) in the US and 400bps in Europe (yield to worst of 4.5%), some way from our strategic targets of 8%+ and ~6%. US investment grade spreads sit around 10 basis points inside European investment grade spreads at 130bps which, fundamentally makes little sense, with European corporates in better condition on average. However, with outright yields higher in the US, we would expect to see further inflows into the USD high quality corporate space with the carrot of close to 4% yields underpinned by a newly-dovish central bank and a rate outlook that is set to be kinder to total returns than was priced a few quarters ago.

The primary market has picked up as the quarter has progressed and late February saw an increasing scramble to the tight end of guidance in all manner of deals. US issuers in the European investment grade space have been particularly prevalent as activity has picked up. The primary market still probably has some way to go to quench the thirst of investors gorging at the goldilocks trough (and let’s not gloss over the sizeable inflows that have been experienced by US investment grade funds since the start of the year). In the absence of sufficient primary market supply, investors are at the mercy of secondary market inventory to fill gaps in their portfolios, which can lead to overshooting in relief rallies and may go some way to explaining spread performance from here.

The primary market has picked up as the quarter has progressed and late February saw an increasing scramble to the tight end of guidance in all manner of deals. US issuers in the European investment grade space have been particularly prevalent as activity has picked up. The primary market still probably has some way to go to quench the thirst of investors gorging at the goldilocks trough (and let’s not gloss over the sizeable inflows that have been experienced by US investment grade funds since the start of the year). In the absence of sufficient primary market supply, investors are at the mercy of secondary market inventory to fill gaps in their portfolios, which can lead to overshooting in relief rallies and may go some way to explaining spread performance from here.

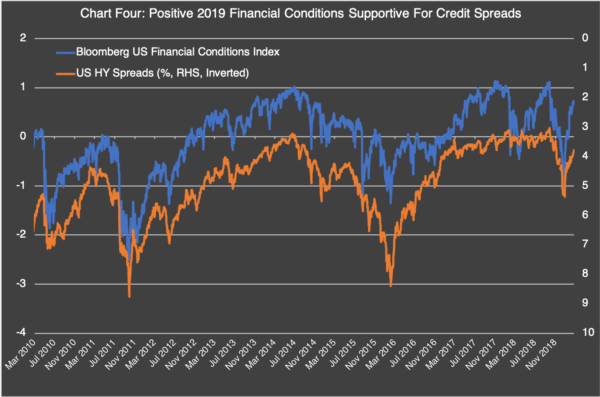

We said last month that we were awake to the short-term trading opportunities presented by the fed “fake” and already we are forced to consider how far and fast the spread rally can sustain. Strategically we see valuations as warranting a defensive bias towards spreads. We do expect further volatility emanating from the fed as strong financial conditions in coming months bring them back to the table for further hikes from here.

We said last month that we were awake to the short-term trading opportunities presented by the fed “fake” and already we are forced to consider how far and fast the spread rally can sustain. Strategically we see valuations as warranting a defensive bias towards spreads. We do expect further volatility emanating from the fed as strong financial conditions in coming months bring them back to the table for further hikes from here.

Credit Positioning Summary:

- In line with our medium-term view for spreads to widen (but not fall off a cliff), we maintain our short bias to European investment grade (yield compensation is simply too low to protect against spread widening)

- We look to the non-rated segment for buying opportunities

- Preference for lower-duration bonds to back away from spread performance

- European high yield companies are in better shape and more attractive than their US counterparts

- We still like Additional tier 1 banks on a relative basis, but price upside is somewhat limited after the recent rally