“We need to incorporate the contagion of narratives into economic theory. Otherwise, we remain blind to a very real, very palpable, very important mechanism for economic change, as well as a crucial element for economic forecasting. If we do not understand the epidemics of popular narratives, we do not fully understand changes in the economy and in economic behaviour.”

– Robert J Shiller “Narrative Economics”

Core Views:

- US: US curve steepening bias, while remaining tactical on duration

- Europe: Remain outright short, looking to enter steepening trades, remain tactical around Italy at current levels

- UK: Entered steepening via LIBOR & gilt futures

- FX: Target USD long position into year-end vs DM and EM

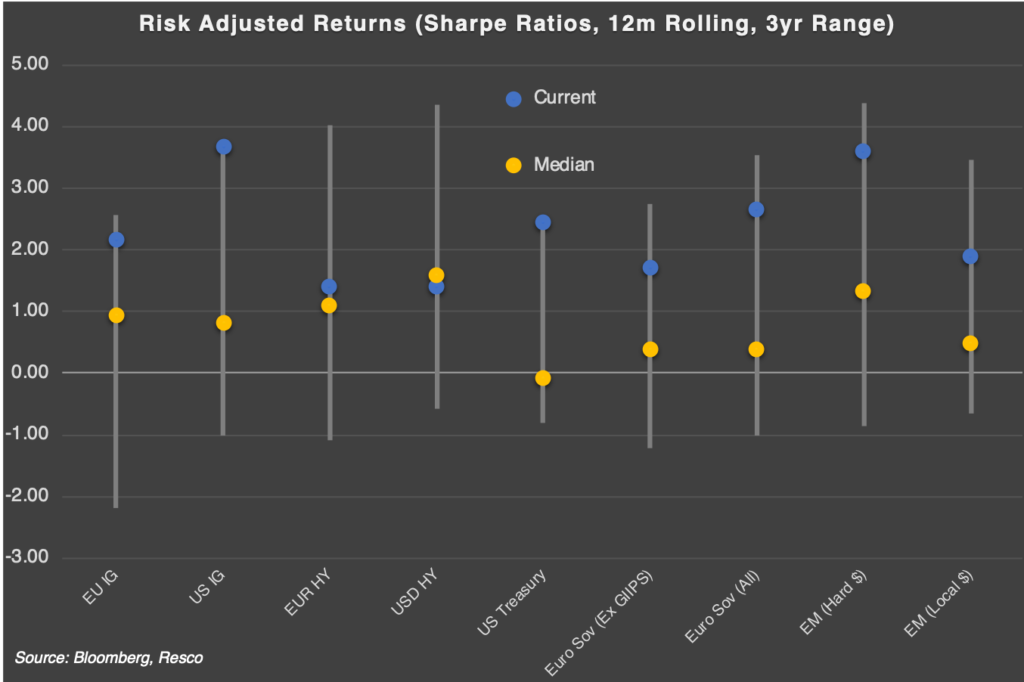

- Credit: Maintain low spread duration overall; focus on single names, having rotated away from smaller issuers; we see wider spreads on the horizon and expect to revisit our strategic entry points across the credit spectrum as and when value arises

One conundrum of living inside a macro management world is that we never stop asking why markets are doing what they’re doing, but often the answers are: a) illusory; b) incalculable; or c) un-investable.

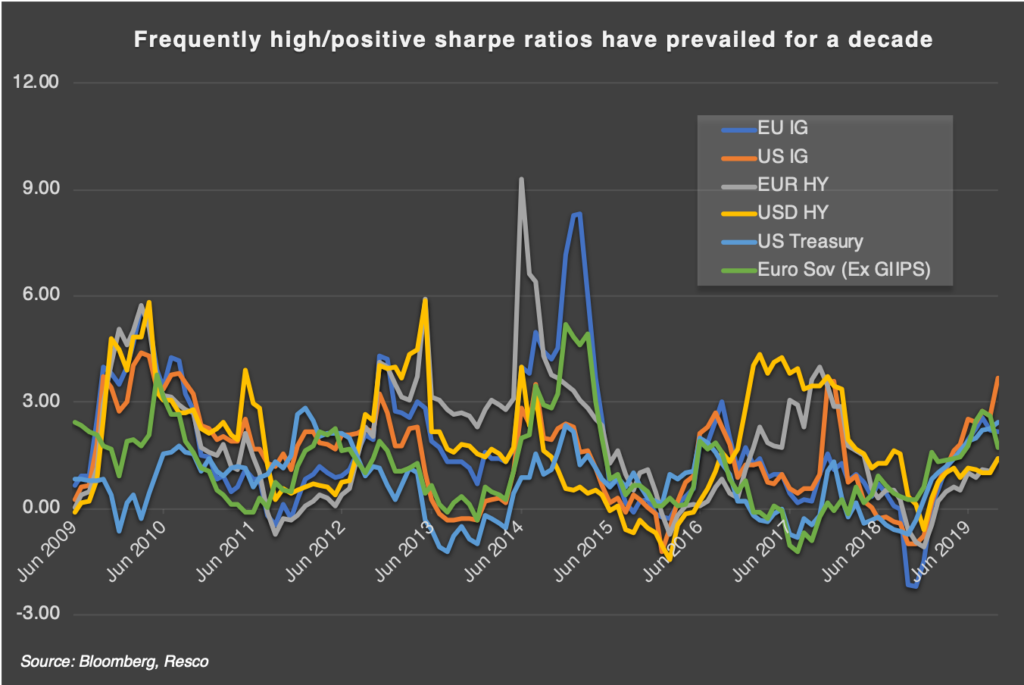

Today’s dynamics and narratives such as bond rallies, equity rallies, negative rates, low volatility, low inflation and yield curve inversions are driving economies because of our belief in their momentum. We believe a bond rally has momentum, so it floods the world with money through suppressed, flat yield curves. We believe volatility will remain low, so volatility shorts and equity longs drive the ‘listed economy’ higher and encourage boardroom arbitrage with buybacks in favour of cap-ex, and so on.

Momentum is everywhere we look, and at this stage of the cycle momentum presents itself as an enormous risk premium. If you were buying 30-year Treasuries at 2% in July this year because you thought buying momentum would persist, you were risking 20%+ of your capital on a 1% reversal in yields – a level we saw just four months prior. If you’re buying US equities right now because you believe momentum will persist, you might consider the 24 December 2018 S&P 500 close of 2,351 (25% below today’s market) to be the risk premium you are paying for that belief. You’re taking big risks; you’re paying big risk premia.

These bets may pay off – equities can go higher; yields can go lower. It is a ubiquitous human condition to search for complexity in the answers to important questions, but the simple answer to the complicated question about when normalcy will be brought back to risk premia is simple – we don’t know.

But it is not knowledge that is driving today’s markets and economies, it is belief. It is ok to believe, but one must grade the conviction of that belief appropriately. We love looking at historical Resco presentations combined with actual risk taken to examine what we believed, how we graded those beliefs and what the results were.

Here we’ve opened up the time capsule; this is what we believed one year ago based on the interpretation of the information we had – it is written in present tense as at November 2018:

- FOMC will continue hiking rates, with a likely pause (June/Sep 2019) at 3%.

- Bond markets will likely overshoot in anticipation of a more hawkish Fed pace in the coming months. (We see this as a fade.)

- ECB Depo Rate should be at 0% by End of 2019. Market prices 15 bps only. More liquidity provisioning through LTRO will be supportive for Peripherals and Financials.

- Trade war irritations will continue. Bigger picture is China and the US wanting to be great again.

- Credit spreads to widen with BBBs particularly vulnerable.

- US credit fundamentals to deteriorate, EU HY spreads are too tight at current levels.

Some conclusions were right and some were (spectacularly) wrong. The purpose of showing this, however, is to highlight what macro investing is all about: identifying market narratives (themes), forming views and expressing those views in order to benefit when the narrative moves.

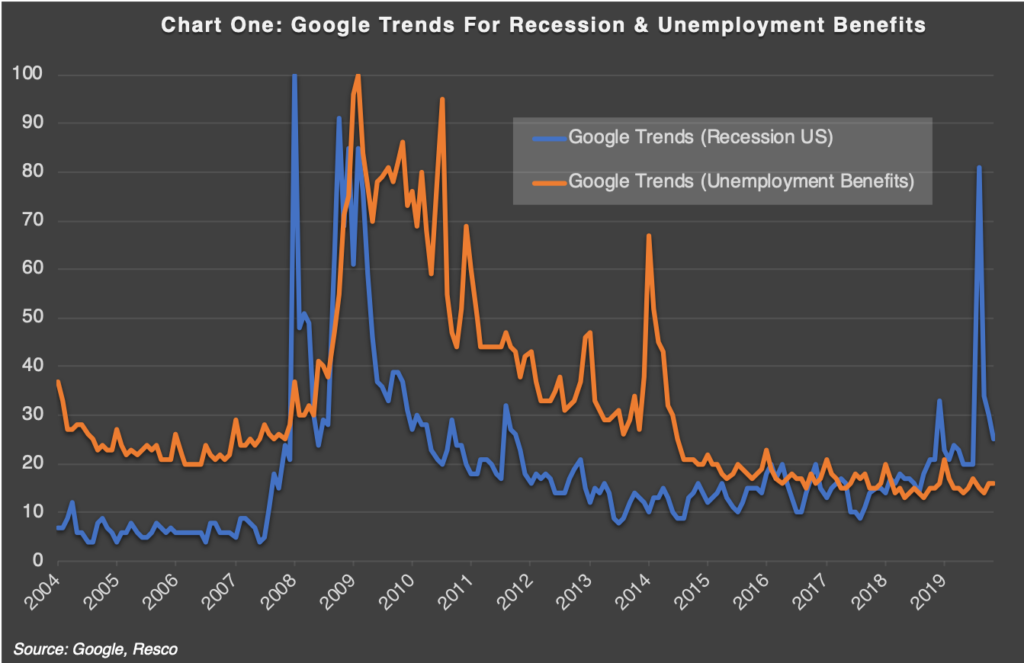

- The US recession narrative reached news highs in August and has since normalised, while no signs of employment fears are emerging

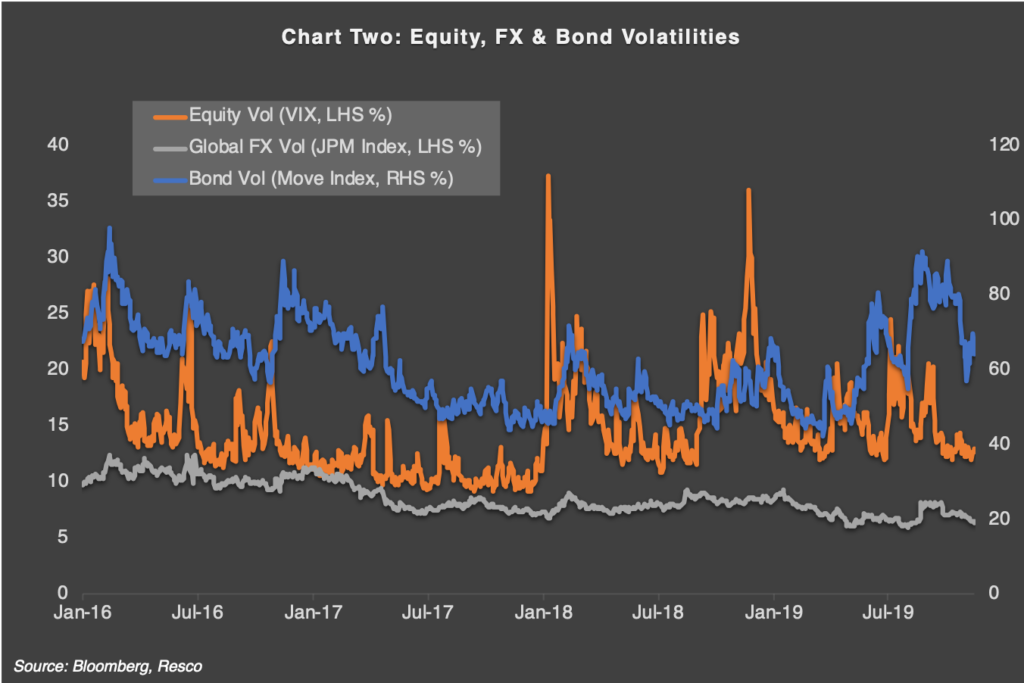

- Implied equity & bond volatilities collapsed following the October FOMC, cementing a goldilocks narrative expectation into year-end

A narrative to us is a dominant market belief system which can be true but doesn’t necessarily have to be. Recent recession fears (see Chart One), for example, while not disproven as untrue, were a driving force behind bond rallies and can still be self-fulfilling in shaping economic realities. Our continued view that the US will avoid a recession is not driven by whether we believe it will happen or not, but rather what we believe markets might be pricing in next. In this context, the ongoing bond market correction is crucial in forming the view that the odds have changed and, to some degree, solidified our trade rationale of shorting bonds as the narrative shifted. This leaves us currently on a goldilocks path for risk markets and collapsing volatility (see Chart Two), which makes sense and offers opportunities to re-position for the next narrative to unfold.

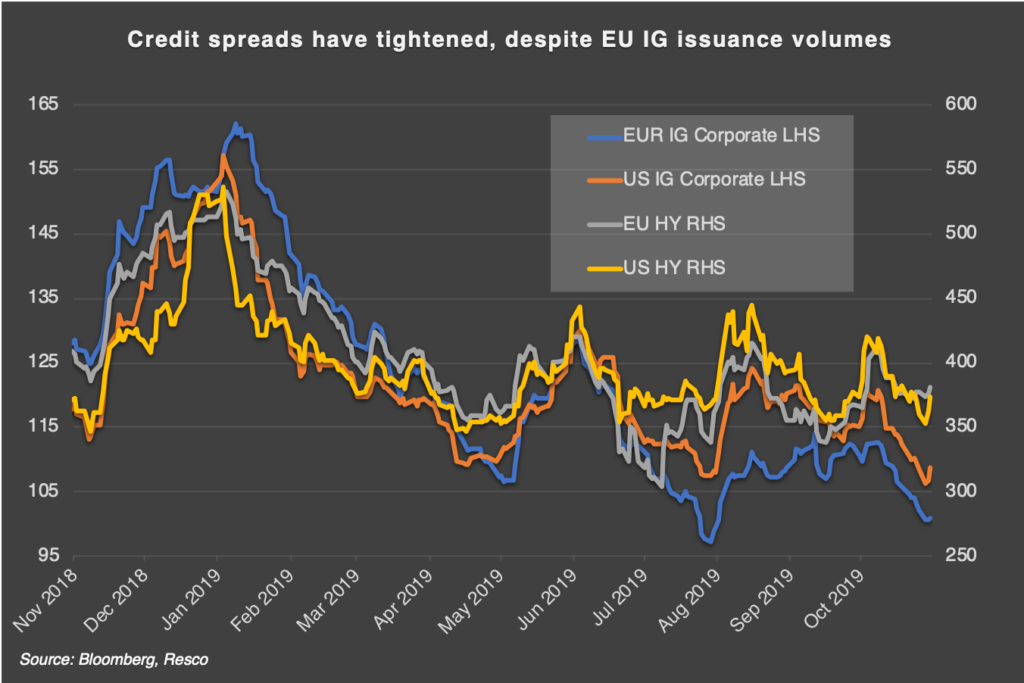

Twelve months ago, we also feared greatly for credit markets, with valuations stretched as fundamentals slipped and shareholder friendly-activity continued, albeit more so in the US than Europe. Almost 12 months on from the December 2018 widening, we find the market crowding the same trades on the belief that the momentum in risk-taking behaviour will continue on the back of easy money.

The conclusion to this is that we must behave like the economy that we want to become. But why should the virtues of investing prevail (which requires speculation that respects valuations) when cheap money fuels momentum? Central banks may not have the ability to influence conventional measures of inflation right now, but they do have the ability to curb the behaviour that is ignoring the price being paid for market risk.

John Howard is an ex-Australian Prime Minister and conservative party elder there, who presided over some of the Australian economy’s most notable boom years. This year he has consistently criticised the Reserve Bank of Australia for cutting interest rates too aggressively – not an uncommon view from ex-politicians who are no longer running for election, but potentially an untainted one. The desperate pre-December-2018 dash back to central bank rates that might once again prove useful during the next crisis has been forgotten about.

Sentiment drives investor behaviour, behaviour drives markets, and markets are driving the economy. And what lasting economic good is coming from contemporary narratives?

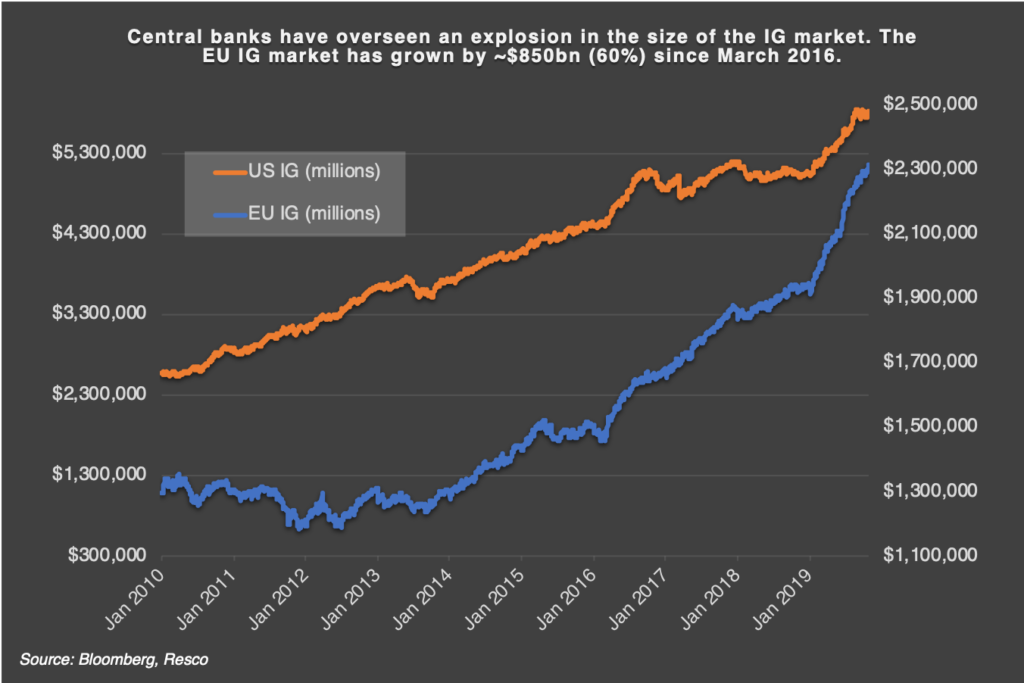

Corporate fundamentals in the US and Europe will again weaken if debt and buy-backs continue to outrank cap-ex in the context of boardroom opportunities. According to S&P, credit quality among rated corporations in the U.S. softened again in the third quarter of 2019, European investment grade corporates increased leverage, and high yield corporates are being downgraded on balance. Cheap money is soaking up bumper European investment grade issuance amidst the largest primary volumes seen in over 10 years. And still, European investment-grade spreads tightened during the month.

Revisiting the quote “Everything stinks ‘till it’s finished,” we are still hating the hated rallies that make sense only to the tenets of momentum. But it is wrong to excuse ourselves as pawns in this game. If we collectively believe that central banks must bring back rates that will combat the next crisis and reconfigure our expectations accordingly, we will allow the central bankers to move to where they have to be.

Until then, contemporary narratives are a moving feast, and we must position ourselves tactically as a result and be mindful of a coming crisis, because history tells us that we are due for one. Here is a summary of our positioning.

Summary:

- Positioned defensively as further risk market weakness is anticipated in the coming months

- Global & US data has somewhat stabilised, while inflation readings are slowly rebounding

- Government rates offer protection only from a recession scenario and/or aggressive cuts into a new negative rate paradigm

- Credit spreads still driven by external rather than fundamental factors, while fund flows are important for spreads to remain stable – we remain defensive and prepared to take advantage of wider spreads to come

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team