“There are lots of things that can go wrong here. It’s possible that we’ll look back in six months and say – it’s not so bad, we overreacted. But we wouldn’t want to look back in six months’ time and say we under-reacted.”

– Dr. Thomas Frieden, former Director of the US CDC

Little did we know that our wipe-out narrative in last month’s thought piece would so violently morph into reality just weeks later. We have little to add in terms of what course the outbreak will take and are following the news flow regularly – we are hopeful that leaders will do their best to serve the public and wish all of our readers the best throughout this event.

It is clear that the preventive government actions to shut-down parts of every-day life and isolate affected and endangered citizens will result in sizeable economic costs, which are hard to estimate, but ostensibly necessary in order to slow the spreading. It is also relatively certain that the news flow around Europe and the US is going to intensify over the next few weeks and months while better developments can be observed in Asia.

Central banks have already taken unilateral action and have indicated that more will be done to ensure financial stability. Fiscal stimulus packages are being prepared as financial markets seem so far unimpressed by what central banks have delivered. The analogies with 2008–especially after the volatility and ferocity of moves seen over the past few trading days–are omnipresent. The difference we see with this comparison is that this time we are not dealing with a constrained supply of liquidity, which led to systematic problems through banking channels, but rather a constrained demand driven issue, which cannot be fixed by current monetary policy levers themselves. The fiscal response, therefore, will have to be directly pointed at solving short-term cash-flow and working capital issues, especially for SMEs. How quickly this can be done? We do not know the answer but it is clearly not as simple as keystroking reserves onto a clearing bank’s balance sheet in a few seconds, such as the case would be with a contemporary liquidity crisis.

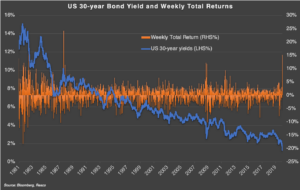

Financial markets have obviously reacted in dramatic fashion. If we had to summarise the state of play in one chart, we would be looking at the price-performance of the US 30-year bond as a barometer of economic pricing and risk aversion. (We had a 29% return in 2-days, which hasn’t happened since 1987 when yields were notably higher).

What now? We have long argued that the next type of crisis would bring monetary and fiscal coordination closer to the front (Modern Monetary Theory). We are now going to witness it in the coming weeks and months. Central banks will cut rates to zero or their desired effective lower bound and provide enough liquidity to their financial system and, in the case of the Fed, to the wider world, should USD funding stresses become apparent. From there only time will tell whether the measures taken should be enough. A 1-2% of GDP fiscal boost sounds like a lot but nobody can claim to know whether it is going to be sufficient to cushion the negative impact on growth. Reflecting on the above quote, we all hope that authorities will overreact rather than under-react as we will look back at this time a few months from now.

Fund Performance & Outlook

While we normally don’t comment on fund performance in our monthlies, we are aware of significant moves in peer performance and want to address this mid-month. The Resco Macro Credit Fund was positioned defensively over the past few months, which has resulted in positive returns during the recent volatility. While we expected a correction and hence reduced our exposure to corporate credit and increased macro hedges through rates and FX positioning, we obviously did not foresee the speed and extent of financial market turbulence that ensued, especially the events over the past few days.

We have further reduced some credit positioning in the immediate fallout, while markedly reducing our rates exposure, especially to longer-dated bonds, while maintaining a steepening bias. This ensures flexibilities around taking tactical exposures as well as helping us prepare for the next phase of either sustained/increasing volatility or a reversal as policy actions support markets.

Looking through the current storm we think valuations in certain segments are becoming attractive again, with IG spreads at least 60bps off the tights and some high yield names over 400bps wider in a matter of weeks, as the resilience of certain business models is being tested. We will rebuild exposure starting with higher quality names and national champions from developed market bank and specific corporate sectors (industrials focused).

With our view of immediate policy action, government bonds, especially longer-dated ones, offer little upside aside from short-term portfolio diversification benefits, although this has also been fading given the extent of the rally in fixed income we’ve seen.

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team

A Word on Resco: Resco Asset Management Limited is a 30+ year project that aims to join other like-minded firms in lifting the perception of the investment management industry, while maintaining a laser-sharp focus on net returns by charging sensible fees and limiting fund expenses. Keen for their friends and family to see the virtues in solving investors’ problems and to be looked upon just as favourably as any other corporate innovator, its three co-founders focus on aspects and values that can drive healthier relationships between them and their community of investors and observers.

Resco’s first product, the Resco Macro Credit Fund, is a global absolute return unconstrained fixed income product that aims to capture performance from global macro themes and corporate bonds to deliver positive total returns to investors throughout market cycles, leveraging its portfolio managers’ existing 10-year+ track records.

The three co-founders own 100% of the business and mandate a majority future executive ownership, thus remain focused on the long-term goal of building a trusted reputation upon a culture of investment excellence, without applying conventional short-term incentive structures that can tempt individuals to overrepresent their particular field of expertise during various cycles. This promotes a meritocracy while allowing senior managers to assume accountability, by focusing on process before individuals.

Its vision to ‘Create a more prosperous world’ signals Resco’s commitment to contribute to a rising tide of prosperity at all levels, through investment management, corporate transparency, community involvement and philanthropy. Resco is a signatory to the UN Principles for Responsible Investment.

All content included in this presentation is for information purposes only and neither constitutes investment advice nor an offer to to issue, solicit or sell any investment.

Resco makes no undertaking, warranty, guarantee or representations as to the reliability, accuracy or completeness of any information contained in this document, which contains opinions of the manager. This document is confidential and must not be distributed or disclosed to those other than to whom it is addressed without the explicit prior written consent of Resco Asset Management Limited.

Resco Asset Management Limited, 71 Central Street, London EC1V 8AB. Resco is a registered trademark of Resco Asset Management Limited. Resco Asset Management Limited (814308) is authorised and regulated by the Financial Conduct Authority.