“As flies to wanton boys are we to the gods, they kill us for their sport. Soon the science will not only be able to slow down the ageing of the cells, soon the science will fix the cells to the state and so we will become eternal. Only accidents, crimes, wars, will still kill us but unfortunately, crimes, wars, will multiply. I love football. Thank you.”

– Eric Cantona

Core Views:

- US: US curve steepening with short duration bias

- Europe: Looking to enter steepening trades

- Australia: Entered short rates positioning on 10-year

- FX: Open new longs in NOK and BRL, cut long JPY position

- Credit: Maintain low spread duration overall; focus on single names, having rotated away from smaller issuers; we will await wider spreads before increasing allocations

Eric Cantona, for those less familiar with football or soccer, was a prolific and charismatic player for Manchester United, known for his on-pitch brilliance and occasional controversies. The above speech (video left) that he gave at the UEFA’s Champions League draw a few weeks back left onlookers stunned. In drawing parallels between Shakespeare’s King Lear and football, “King” Eric was labelled crazy and deluded, with echoes of his famous sardines & trawler monologue from the mid-90s when he was banned after attacking a fan.

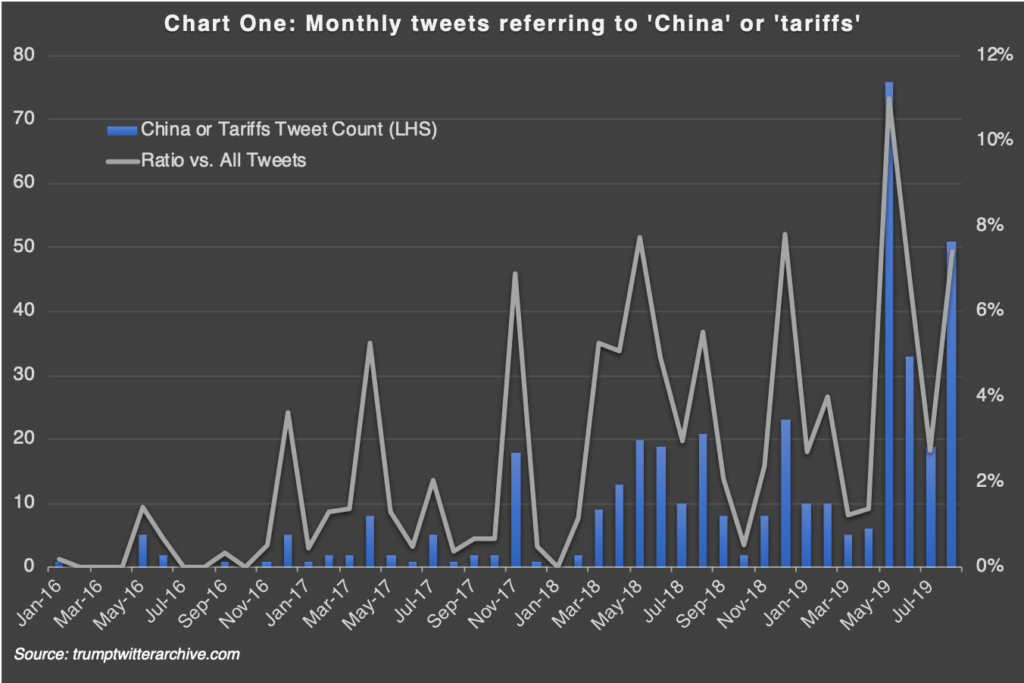

The over-interpretation of Cantona’s philosophical anecdotes reminded us in many ways of how August’s financial market gyrations were in fact activated by the weight markets’ placed on White House tweets (see Chart One).

The fine art of separating noise from signal becomes a lost cause when faced with a daily average of two indiscriminate statements on a platform that has become a powerful political and economic lightning rod for the world’s most powerful leader. Although the tweet frequency will be maintained, we sense that we’ve already past ‘Peak Trump’ in terms of the impact of each of his tweets on markets, which is only natural given the expected diminishing weight due to repetition and the oscillating nature of his negotiating tactics with China. ‘Central banks trump politics’ is the layered catchphrase we now have in big and bold on our office white board, meaning that we must remember to find trade opportunities in the markets’ responses to politics in order to anticipate a reversion back to where core central bank behaviour would see prices.

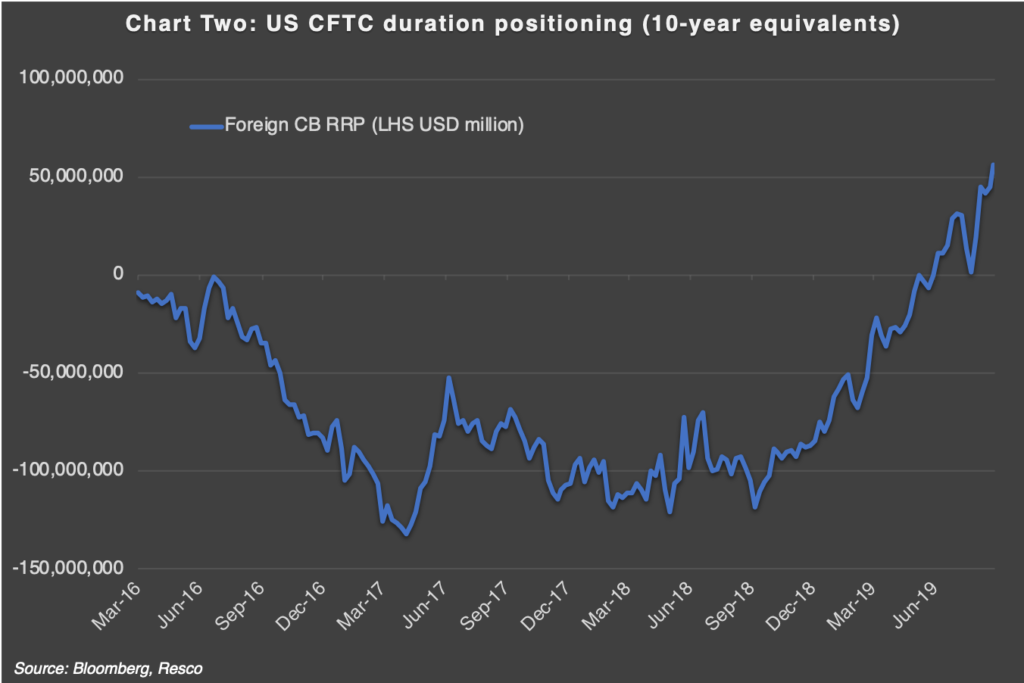

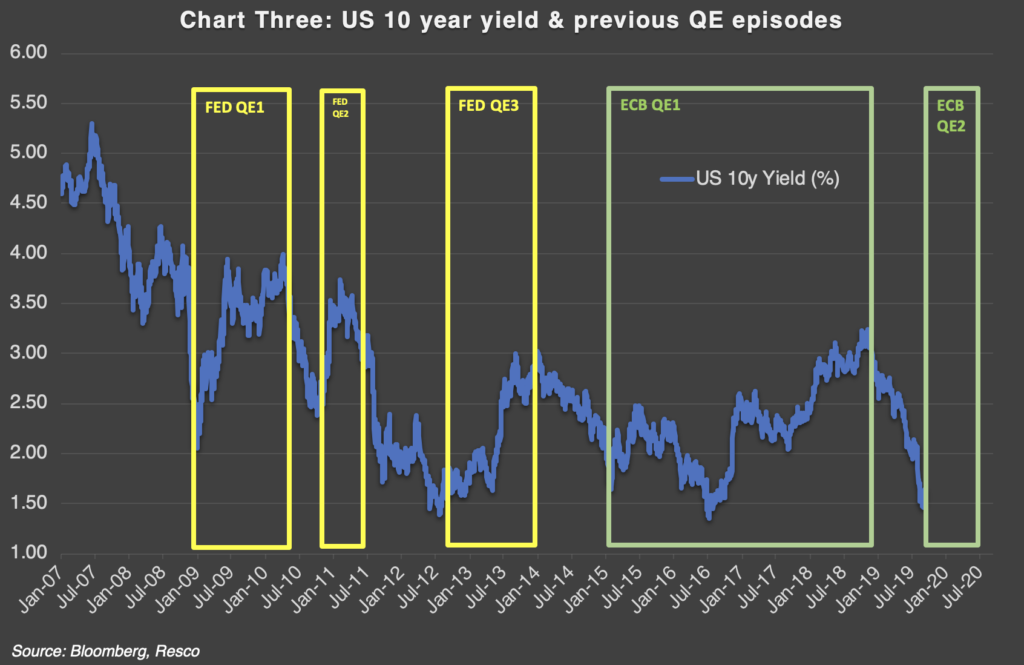

With two important monetary policy meetings set to dominate in coming weeks, it is notable that rates markets more or less discount sizeable easing moves by both the ECB & FOMC, not only for this month but also the quarters ahead. With duration positioning now exceeding readings at the previous yield lows in 2016 (see Chart Two), it wouldn’t take much for the bond rally to reverse some of its recent gains. After all, if the credible easing and liquidity injections manifest as expected–at least by the ECB–we should see bond yields lift (see Chart Three).

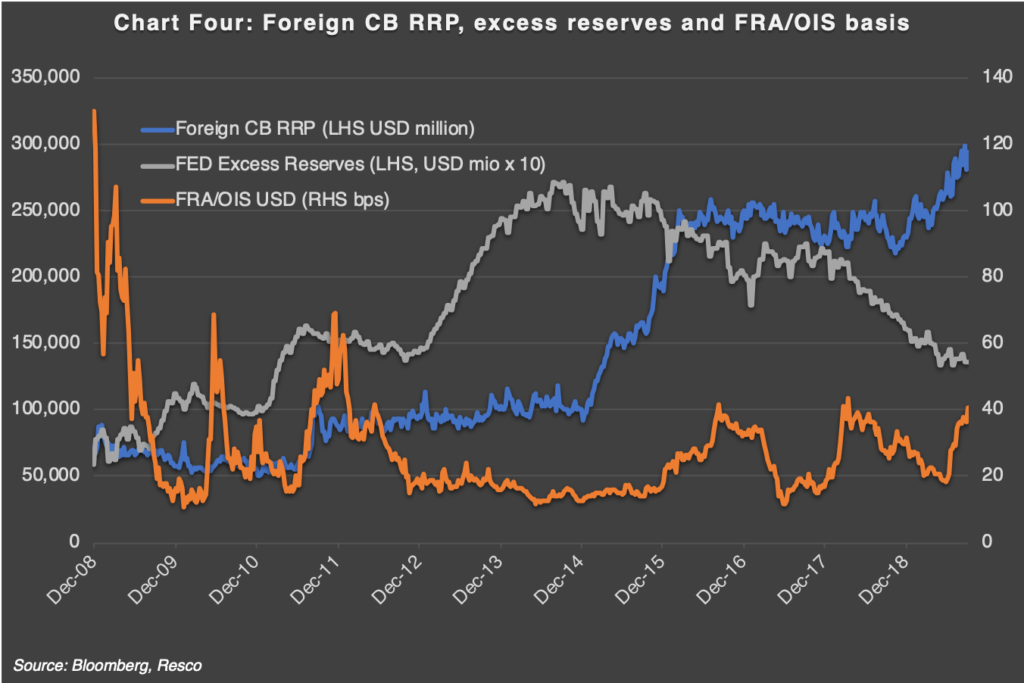

Meanwhile, August’s flattening of yield curves is draining excess reserves at a faster rate, as the Fed’s overnight reverse repo facility rate (around 2%) becomes a more attractive alternative for official institutions than buying US Treasuries outright, which also explains recent weakness at Treasury auctions (see Chart Four).

- Tariff & China noise since Trump’s election has increased markedly and reached new highs this year

- Our estimate of US duration positioning reached a new high recently (includes all exchange-traded futures)

- Historically, QE implementation lifted rates globally as the expected reflationary impact from monetary policy was being priced in

- Flat US yield curves entice cash rich foreign central banks to access the Fed’s Reverse Repo Facility which drains liquidity and puts pressure on overall funding rates

Higher funding rates (higher FRA/OIS) is effectively ensuring a tighter stance than intended, which the Fed can reverse by either cutting rates aggressively or providing additional liquidity through QE, or both.

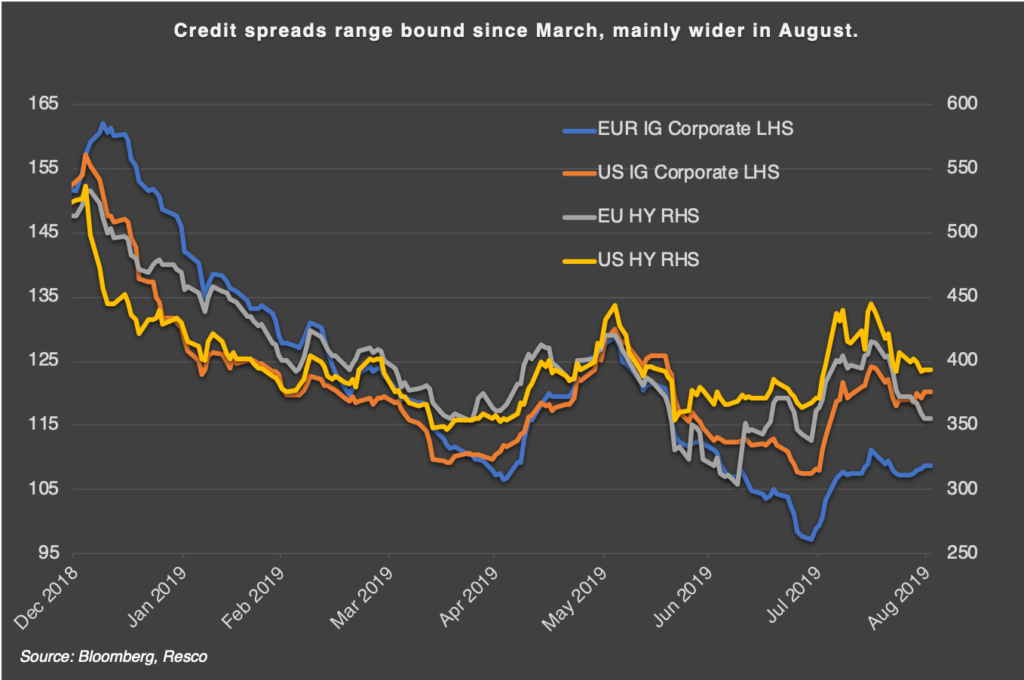

Our credit models both for EUR and USD spreads indicate we are still settled in unattractive territories from a top down perspective. While spreads sit some way off their tights, high universe durations, historically low yields and deteriorating index fundamental quality weigh against any extended long positioning. Fund flows to the asset class are starting to present a more mixed case but have been supportive for several months, with the primary market calendar having been easily digested by investors so far, certainly to August month end.

We continue to see a challenging outlook for risk asset performance in the months ahead. The expected monetary support is unlikely to resolve the overriding problem of lacklustre nominal growth going forward. We would caution against expecting different economic outcomes this time around. Recent diverging views within major central bank committees also reflect the fact that close to ZIRP or NIRP monetary policy alone cannot sufficiently alter inflation expectations. In this context, it is notable that our previously-expressed views for more fiscal expansion are gaining traction and support from large money managers and academics alike.

What is still clear to us, however, is that the path to more aggressive monetary and fiscal stimulus requires justification, which the market is not presently providing. We see higher highs for risk markets during this cycle if we are dealt a rougher ride in the short term; i.e., a central bank reaction to risk headwinds may tease out an extended risk rally, whereas a more linear path to new (yet muted) highs may perversely be the result of receding recession fears. All manner of previously unseen, bright and bold forms of stimulus need a bout of financial market instability to be activated. That remains our base case. Tweets won’t change that.

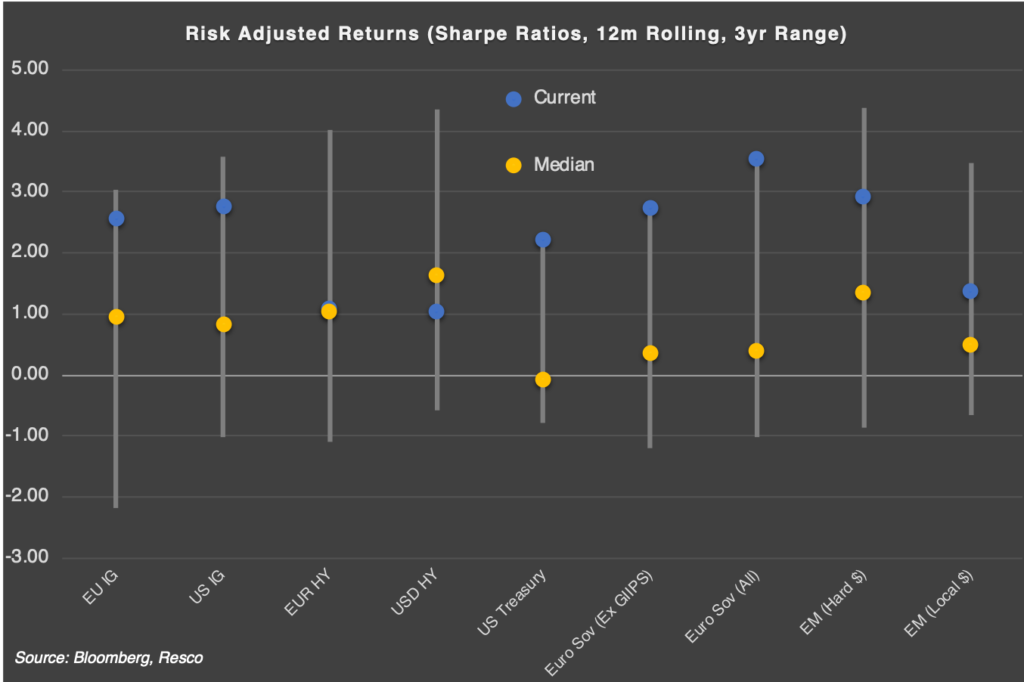

- Total returns for credit markets have been heavily reliant on underlying Treasury performance

- Risk-adjusted returns sit above the three-year median for most segments, with USD and EUR government universes setting new three-year Sharpe highs

Summary:

- We see potential for further risk market weakness in the coming months

- US data has deteriorated but is not recessionary, while inflation readings are rebounding

- Government rates offer protection only from a recession scenario and/or aggressive cuts into a new negative rate paradigm

- Credit spread levels are being driven by external factors rather than tracing the evolution of underlying fundamentals; fund flows are important for spreads to hold steady.

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team