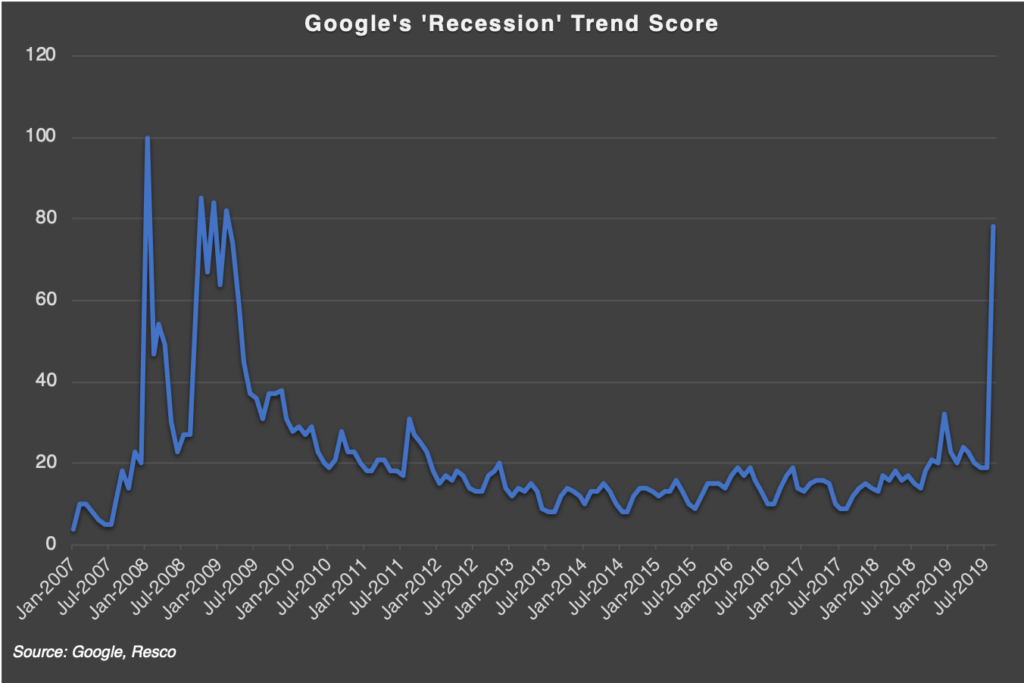

“People stop buying things, and that is how you turn a slowdown into a recession”

– Janet Yellen

No US President has had to seek re-election during a recession since Jimmy Carter in the late ’70s, and his attempt to do so resulted in a one-term presidency for him. While talk of recession is being driven more by US yield-curve dynamics than economic data, US President Trump and the Republican lawmakers in Washington DC would be crazy not to do their utmost to avoid rising noise about a recession as they head into the 2020 election campaign over the next year.

Core Views:

- US: US curve steepening bias while remaining tactical on duration

- Europe: Flattening with an overall short bias; closed long Italy position after hitting targets

- UK: Remain tactical with heightened political noise

- FX: Took profit on short CAD/USD and long RUB/USD positions while keeping longs in JPY; strategically looking to be short USD vs both EM and pro-cyclical DM currencies

- Credit: Low spread duration; focus on single names, having taken profits and rotated away from smaller issuers; we see wider spreads on the horizon and expect to revisit our strategic entry points across the credit spectrum

“Bang!” is one of the more popular words used in the Resco office. A short, catchy word repeatedly used to announce the advent of volatile market events. It became so engrained in our subconsciousness that wherever we would travel it would manifest as signage and pop art, reminding us of the shudder that can reverberate through markets and the press when cracks appear in markets.

It should come as no surprise to our readers that the word-count for “Bang!” exceeded July’s lacklustre reading in the first few business days of August. A remarkably rational and honest Chair Powell during July’s FOMC press-conference followed by the prompt re-escalation of trade war rhetoric delivered the first of many “Bangs!” in August. Any cartoon fan would know that where there are “Bangs!,” you will often find a “Kapow!” or a “Whack!”. A swift response by the People’s Bank of China (PBoC) to weaken the Chinese Renminbi past the psychological 7 per USD exchange rate level provided just that and invalidated last May’s trade-war playbook.

The game-theory idea that President Trump would willingly incite market weakness to move the Fed around the board faster than its current path leaves us with a market configuration that is both precarious and full of opportunity. At this stage, the Fed is unwilling to move into a more aggressive mode or explore new policy territory with data slowing and financial markets showing little signs of investor panic.

US equities are still close to all-time highs and moves in the US-dollar are not dramatic. While credit markets have suffered since early August, the underlying government bond rally has compensated corporate bond investors in many cases, given the intense focus on outright yield rather than spreads in isolation.

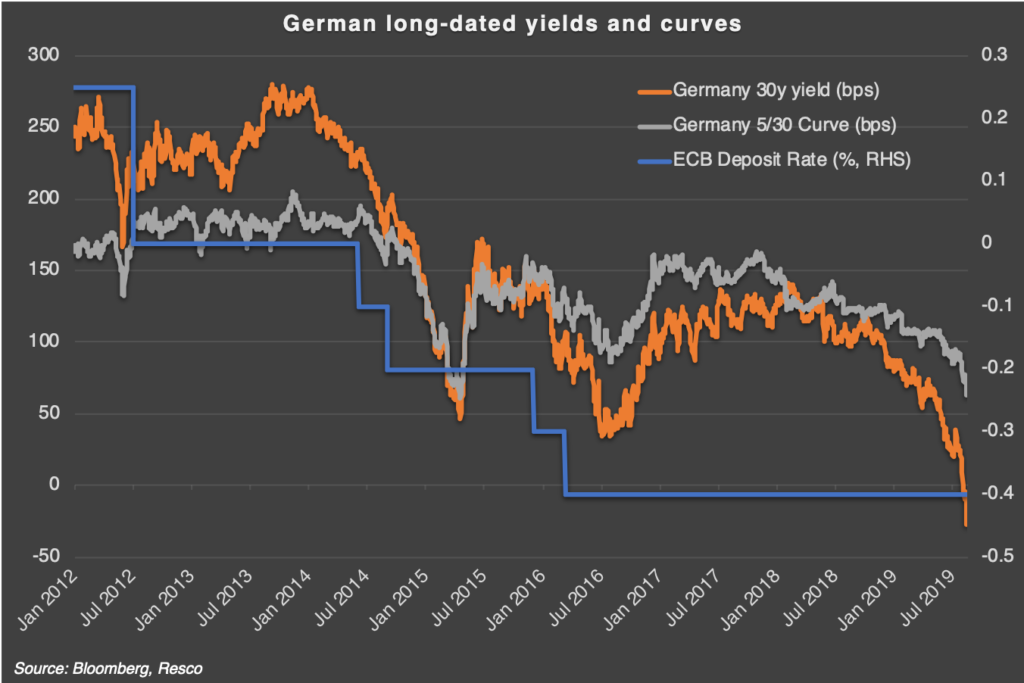

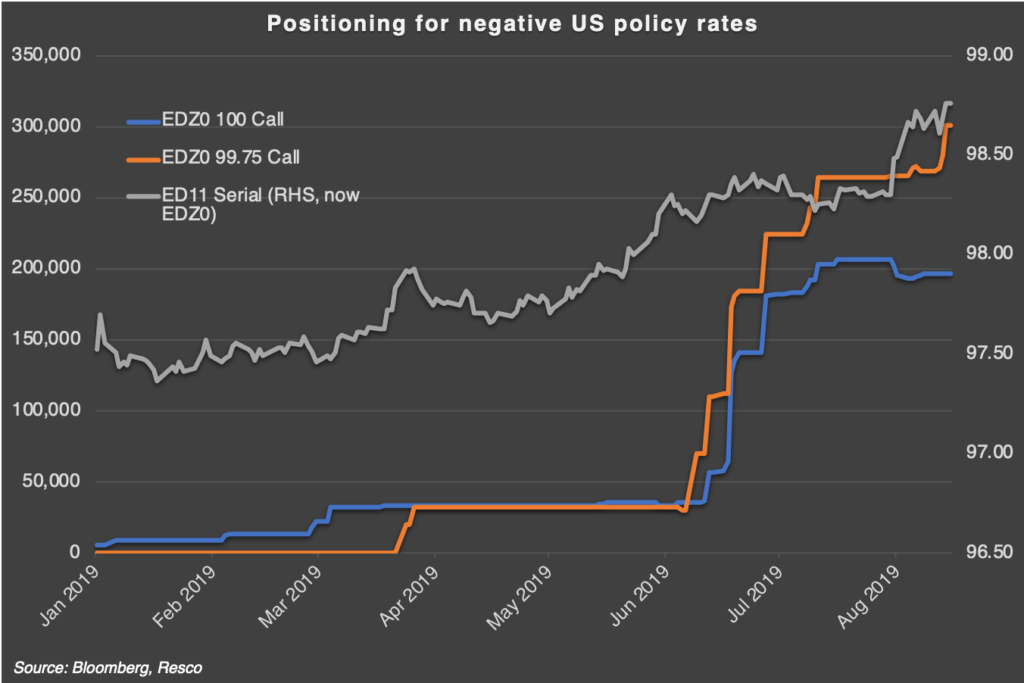

This spectacular rally of developed government bond markets has seen new records hit in long-dated maturities, with 30-year German yields in negative territory and the US equivalent dipping below 2%. While the front-end anticipates terminal Fed Funds for now to be around 1% by the end of 2020 and offers a base from which to build a strategy, the collapse in long-dated forward rates leaves the Fed and investors hypothesising as to where the long end will settle.

Credibility, if still existent, should price central bank stimulus powerfully enough to return nominal growth to a natural level. Alternatively, the possibility of negative policy rates in the US opens a new investment chapter that cannot be dismissed. It is in many ways reminiscent of the time when the ECB cut rates below the magic 1% level for the first time, and then into negative territory just to start QE in 2015. As such, it is imperative not to exclude any possibilities as far as central bank action is concerned.

With this in mind we see a growing window for risk markets to trade weaker. Importantly, data is not providing the Fed with the impetus it needs to enact anything outside of conditional easing. The current status of market stability does not demand any non-traditional intervention (yet). In Europe, the ECB finds itself in a tighter corner, with equities continuing their long drag to lower levels and bank stocks revisiting all-time lows. Funding and liquidity are not widespread issues on either side of the Atlantic, yet inflation has consistently undershot targets and economies are slowing, while there is a challenging fundamental dynamic underway in certain markets as we have previously referenced with respect to the growth of zombie companies.

We believe that markets themselves will have to provide the ammunition for central banks to fire, in the form of a period of financial market instability. Sequencing the bigger picture, however, we see longer-term bullish opportunities for risk, given our expectation that central banks will eventually (even this year) be forced to use “Bang!” and “Kapow!” methods of accommodation to lift inflation, with or without the catalyst of a bear market for risk assets.

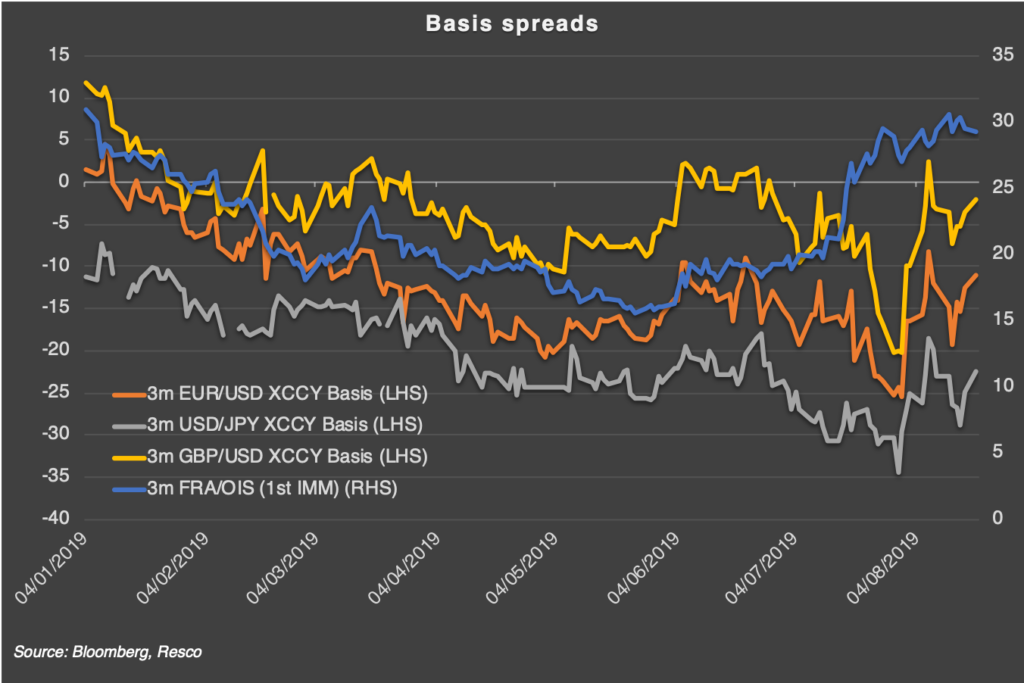

- The spread between forwards linked to $ Libor and U.S. index swaps (FRA/OIS) has propelled rising cross-currency basis swaps

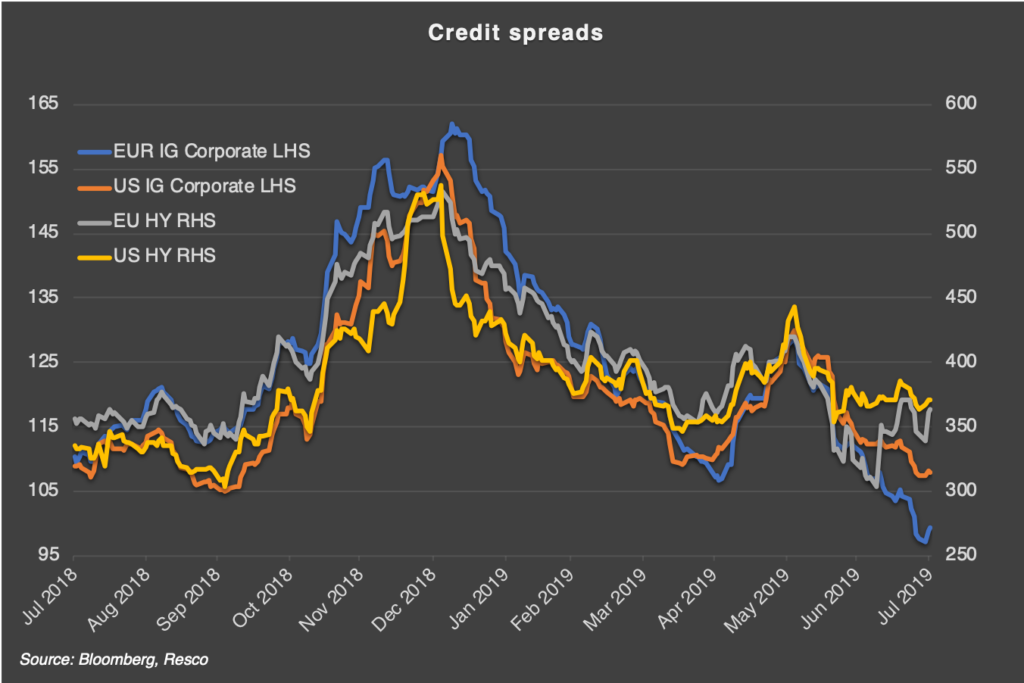

- Credit spreads were mainly tighter over July, with EU HY the under-performer. The credit market has found itself in choppier waters since month-end

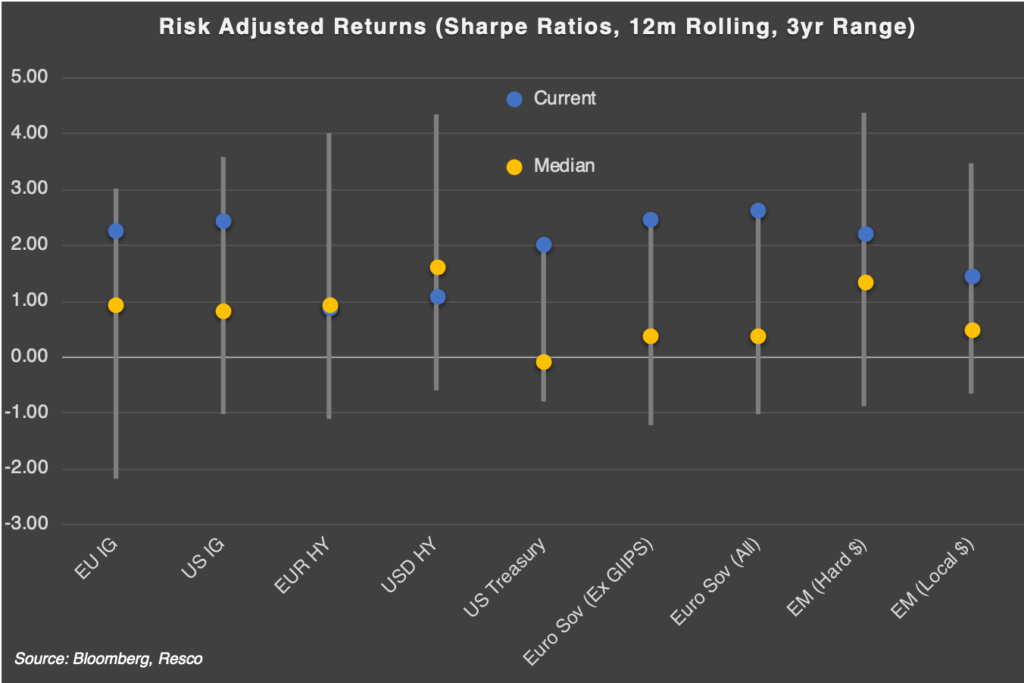

- The recent sovereign rally has pushed risk-adjusted returns in Europe & US to extremes

Summary:

- Positioned defensively as further risk market weakness is anticipated in the coming month

- US data has deteriorated but is not recessionary, while inflation readings are rebounding

- Government rates offer protection only from a recession scenario and/or aggressive cuts into a new negative rate paradigm

- Credit spreads still driven by external rather than fundamental factors, while fund flows are important for spreads to remain stable – we remain defensive and prepared to take advantage of wider spreads to come

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team