“Monetary history reveals the fact that folly has frequently been paramount; for it describes many fateful mistakes. On the other hand, it would be too much to say, that mankind has learned nothing from these mistakes.”

– Knut Wicksell, 1935

“The pandemic will pass while liquidity remains.” This is probably the shortest and simplest description of our current thinking when asked to explain our somewhat bullish financial market view in a nutshell.

Thematically, we expect renewed pressure on the validity of the European project. We remain unimpressed with the Union’s monetary response to the ongoing crisis, resulting our continuing negative view on both core and peripheral debt markets, while preferring to be short the euro. Emerging markets, while attractive in certain segments, don’t offer a good entry point in the absence of credible monetary mechanisms, while USD offshore liquidity appears scarce and still diminishing. A weakening USD trend, which we anticipate will likely establish itself over the summer, will set the buy signal for us in select emerging market foreign exchange pairs and government bonds.

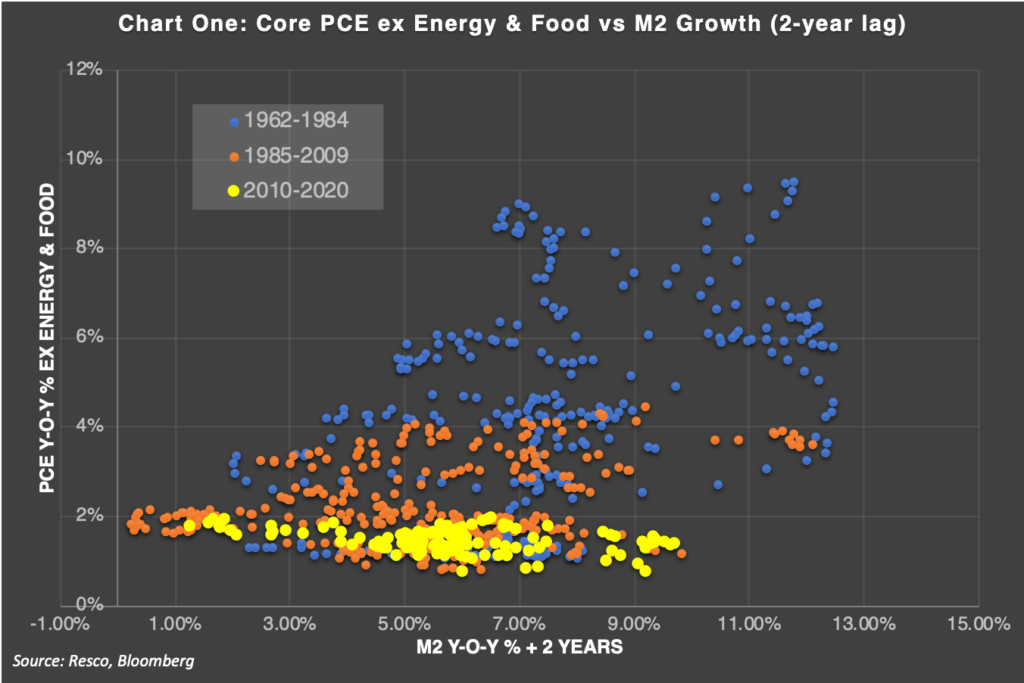

The significant boost to monetary aggregates will unlikely lead to a spike in inflation over the remainder of this year and probably well beyond. The link between money creation and consumer inflation has been broken for a decade and is unlikely to re-establish itself anytime soon (chart one). The link between base money expansion and asset price inflation, however, is positive and a discussion for another time!

Monetary operations, such as quantitative easing (QE), which boost central bank balance sheets, have no effect on consumer price inflation or inflation expectations in a landscape like this, we note as economic textbook theories morph into myths. Money multipliers, for example, have long been rendered useless when analysing inflation outcomes. Similarly, the current discussion around “money printing” through debt monetisation leading to hyperinflation is in our opinion another narrative set to fail.

Direct monetary financing (or overt monetary financing) is identical in process to QE. A central bank doesn’t need the offsetting asset (government debt) given that it creates its own currency out of thin air. The swapping of public debt for bank reserve credits in current QE operations is nothing but an accounting convention.

The recent announcement by the Bank of England and the UK Treasury to re-open and utilise the “Ways and Means” facility is interesting in that it proves this very point. (It is worth reading the Ways and Means April update as well as the recent balance sheet speech from the Bank of England)

Monetary aggregates (like M2) no longer exhibit any link to consumer price inflation since disinflation has dominated over the past 35 years. In the last decade, the period when central bank balance sheet have exploded, the two variables are nearly uncorrelated.

Inflation risks arise at the point of spending (both private and public) if it drives nominal aggregate demand faster than the real capacity of the economy to absorb it. Increased government spending, however, is not inflationary if there are idle real resources that can be brought back into productive use or if they grow in proportion to the growth in productive capacity in the economy.

Having undershot inflation targets for nearly a decade, central banks have ample ammunition–compounded by coordinated fiscal activity–to stimulate their respective economies. This is the regime shift we have been anticipating and is now manifesting in front of our eyes.

While questions surrounding central bank independence will continue, the lack of better alternative solutions following a historic fall in output levels (due to the ongoing pandemic) will leave authorities with little else but an MMT-type coordination going forward.

If Wicksell’s wise words prove any insight, not acting aggressively now would result in a monetary mistake of extreme proportions. We remain optimistic.

Resco’s April positioning notes:

Having entered the high volatility period with a defensive set-up, both in relation to credit spreads and through macro positioning towards risk and volatility, our longer-term assessment of available returns flipped to positive in March.

The decision out of our strategic macro allocation review, which we call our ‘Compass,’ saw us take profit on hedges, reduce our overall duration positioning and buy high quality corporate credit, in this precise sequence.

Our more optimistic outlook for forward returns was predominantly driven by attractive entry points across the credit market alongside our general assessment that more-aggressive-than-anticipated monetary and fiscal interventions would support risk asset valuations. Analysing behavioural patterns revealed record pessimism in the micro- and macro markets we cover, which supported a more constructive view, informed by positive leaning indicators of value in corporate credit, where we have moved to the highest allocation of risk since launch.

In credit, we are focusing on buying higher quality areas of the spectrum only, typically BBB or better. We are mainly buying in primary markets although we have also been adding quality names on weakness in secondary markets, which has largely led us towards companies that were punished for drawing on credit lines to bolster liquidity.

Our rates positions benefited strongly from the dislocation in markets with some of the implemented themes hitting pre-determined take profits levels. As a result, our long positioning in the US front-end was reduced to zero while we also reduced some yield curvature positions that had benefited from the volatility spike in treasuries. Meanwhile, our overall duration long, establish in February, was aggressively cut. We still like the risk-reward in yield curve steepening expressions across a variety of developed market government curves but don’t see value in nominal government bonds.

- Overall portfolio duration was cut aggressively throughout the month as we adapted exposures across US, EU and UK curves

- We reduced our significant long positions in the short-end of the US curve as we hit our target levels and don’t envisage the Fed cutting rates to negative territory

- We maintain our yield curve steepening bias across developed market yield curves

- We reduced FX exposure into the end of February, and opened no new positions in March. We are anticipating an entry point in expressing short USD positions in the coming months

- We tactical managed our short to Italian and German rates position as we are building negative exposure to European sovereign debt

- With spreads having widened materially across the universe, we add a constructive position in IG corporate, increasing target exposure to 90% predominantly through IG primary markets, in EUR and USD

- We do not add risk to subordinated financials or high hield at this stage of the rotation

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team

A Word on Resco: Resco Asset Management Limited is a 30+ year project that aims to join other like-minded firms in lifting the perception of the investment management industry, while maintaining a laser-sharp focus on net returns by charging sensible fees and limiting fund expenses. Keen for their friends and family to see the virtues in solving investors’ problems and to be looked upon just as favourably as any other corporate innovator, its three co-founders focus on aspects and values that can drive healthier relationships between them and their community of investors and observers.

Resco’s first product, the Resco Macro Credit Fund, is a global absolute return unconstrained fixed income product that aims to capture performance from global macro themes and corporate bonds to deliver positive total returns to investors throughout market cycles, leveraging its portfolio managers’ existing 10-year+ track records.

The three co-founders own 100% of the business and mandate a majority future executive ownership, thus remain focused on the long-term goal of building a trusted reputation upon a culture of investment excellence, without applying conventional short-term incentive structures that can tempt individuals to overrepresent their particular field of expertise during various cycles. This promotes a meritocracy while allowing senior managers to assume accountability, by focusing on process before individuals.

Its vision to ‘Create a more prosperous world’ signals Resco’s commitment to contribute to a rising tide of prosperity at all levels, through investment management, corporate transparency, community involvement and philanthropy. Resco is a signatory to the UN Principles for Responsible Investment.

All content included in this presentation is for information purposes only and neither constitutes investment advice nor an offer to to issue, solicit or sell any investment.

Resco makes no undertaking, warranty, guarantee or representations as to the reliability, accuracy or completeness of any information contained in this document, which contains opinions of the manager. This document is confidential and must not be distributed or disclosed to those other than to whom it is addressed without the explicit prior written consent of Resco Asset Management Limited.

Resco Asset Management Limited, 71 Central Street, London EC1V 8AB. Resco is a registered trademark of Resco Asset Management Limited. Resco Asset Management Limited (814308) is authorised and regulated by the Financial Conduct Authority.