Inflation is often seen as a scourge on economies – it is a tax on those with no income growth, it can destroy politicians if allowed to run, and it demands a never-ending balancing act from central bankers. However, without it, the incentive to spend is dampened and the drivers for asset growth become anaemic. This month Resco examines the market’s mood as 2015’s “lift off” ambitions become a distant memory.

“Now the drugs don’t work

“They just make you worse

“But I know I’ll see your face again”

– The Verve

Core Views

- Recession themes too early to enter, as dovish central banks drive risk rally further

- Taking profit on US flattening trades, entering steepening positions

- UK Gilts too rich even under a hard Brexit scenario, short-term tactical trades only

- Curve flattening pressures in Europe to persist, Italy vulnerable at current levels

- Favour non-rated credit, inside 5 years to avoid spread sensitivity

- Continue to favour European additional tier one banks on a relative basis

- Scaling into select investment grade emerging market sovereigns

Macro, by David Ric: My old T-shirt (pictured here), which I so fondly wore when the Fed started hiking three years ago, has been put back in the wardrobe.

Macro, by David Ric: My old T-shirt (pictured here), which I so fondly wore when the Fed started hiking three years ago, has been put back in the wardrobe.

The US rate hiking cycle that started in December 2015 has ended abruptly. Many argue that the political pressure was too much for Chair Powell and his colleagues at the FOMC to continue the path he and his committee still subscribed to when they last hiked on 19 December last year.

The tightening of financial conditions and the resulting slowdown in forward-looking economic indicators, however, are more natural reasons why the Fed chose to pull the hand-brake and all but concede a policy mistake. More importantly, the persistence of low inflation has simply become too much for the Fed to dismiss, as it no longer can be justified as a transitory phenomenon.

Powell emphasised inflation concerns during the March press conference and acknowledged that the Fed had not met the symmetric inflation target in any convincing way. Measured by the annualised rate of change, the core PCE deflator has only been above the Fed’s target for one month since March 2012.

In our last monthly, we highlighted the persistent undershooting of the inflation trend for both the US and the ECB and concluded that more easing or alternative ways of raising inflation expectations should be explored. In that regard, we are looking forward to what the Fed’s review of its policy tools in their June 4-5th Chicago summit will bring.

It seems as though removing extraordinary monetary stimulus is not as simple as it sounds. Moving away from the zero lower bound (ZLB) is after all a road less travelled; it is not only prohibiting traditional rate hikes, but also halting the reduction in the balance sheet run off.

Research by James Bullard from the St. Louis Fed (Seven Faces of “the Peril”) from 2010 illustrated the difficulty of exiting a steady state environment close to the ZLB, as the experience in Japan has shown. While policy makers have fought hard to avoid this scenario, it is hard to argue against the fact that secular stagnation is gripping the Western world at present and will continue to do so for a long time to come.

Massive central bank balance sheets will remain the norm, as quantitative easing (QE) purchases will need to be kept constant to avoid draining liquidity while short-end rates are kept low to make financing costs bearable (Chart One). The large piles of QE stock will never be paid in full, rather they will just be rolled forward to another tomorrow. Such debt piles have, for all intents and purposes, become perpetual obligations.

The re-emergence of “QE Infinity” hysteria had bullish implications for both risky and risk-free assets during the month, although question marks around the state of the economy and the possibility of recession initially restricted investor desire to dramatically extend risk (Chart Two).

Yield curve flattening, once again, raised the debate around not if but when the recession would incur. We’re not big proponents of using the yield curve to predict recessions, thus we look on with healthy levels of scepticism as pundits pick and choose the part of the yield curve which should invert to suit their narrative (Chart Three).

Yield curve flattening, once again, raised the debate around not if but when the recession would incur. We’re not big proponents of using the yield curve to predict recessions, thus we look on with healthy levels of scepticism as pundits pick and choose the part of the yield curve which should invert to suit their narrative (Chart Three).

Inversions close to the ZLB in a world of QE must be taken with a grain of salt. Even if the predictability of yield curve inversions were accurate, it would typically become meaningful 12-24 months before the recession hits. This clearly begs the question of how an investor should structure their portfolios in the lead up to such an event, as sitting patiently on the wrong side of markets for up to two years is not a desirable investment strategy for the active investor.

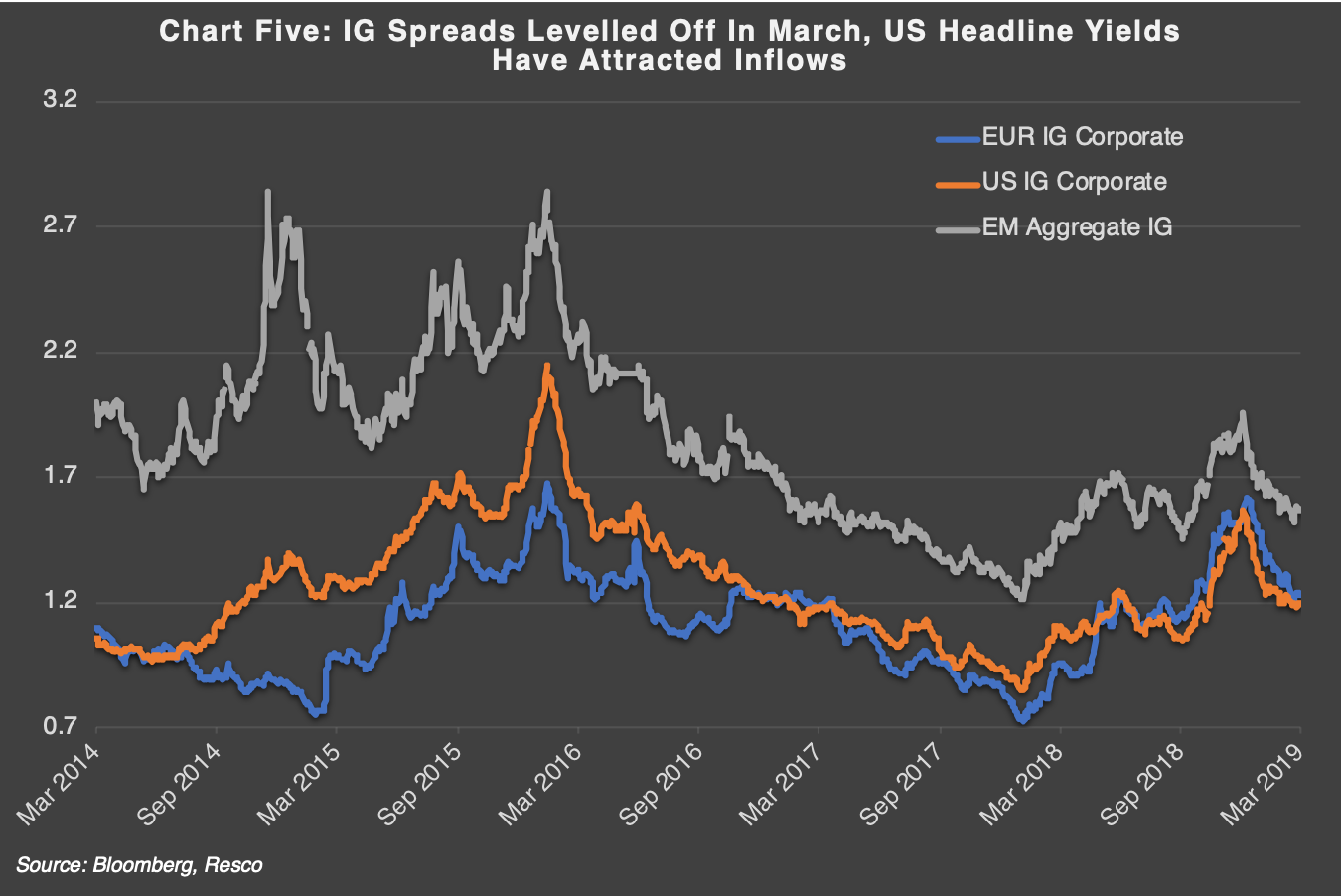

Credit, by Alex Eventon: Looking down the quality curve from governments to the corporates, we see buyers remaining aggressive across the credit spectrum, with the “fear of missing out” trade vacuuming investors further into long risk positioning. However, most of the March action was in the government universe; EUR and USD credit spreads traded only slightly tighter during the month, with underlying government benchmark performance providing the leg up to see credit total returns retain their 45%-degree ascent into the end of the quarter.

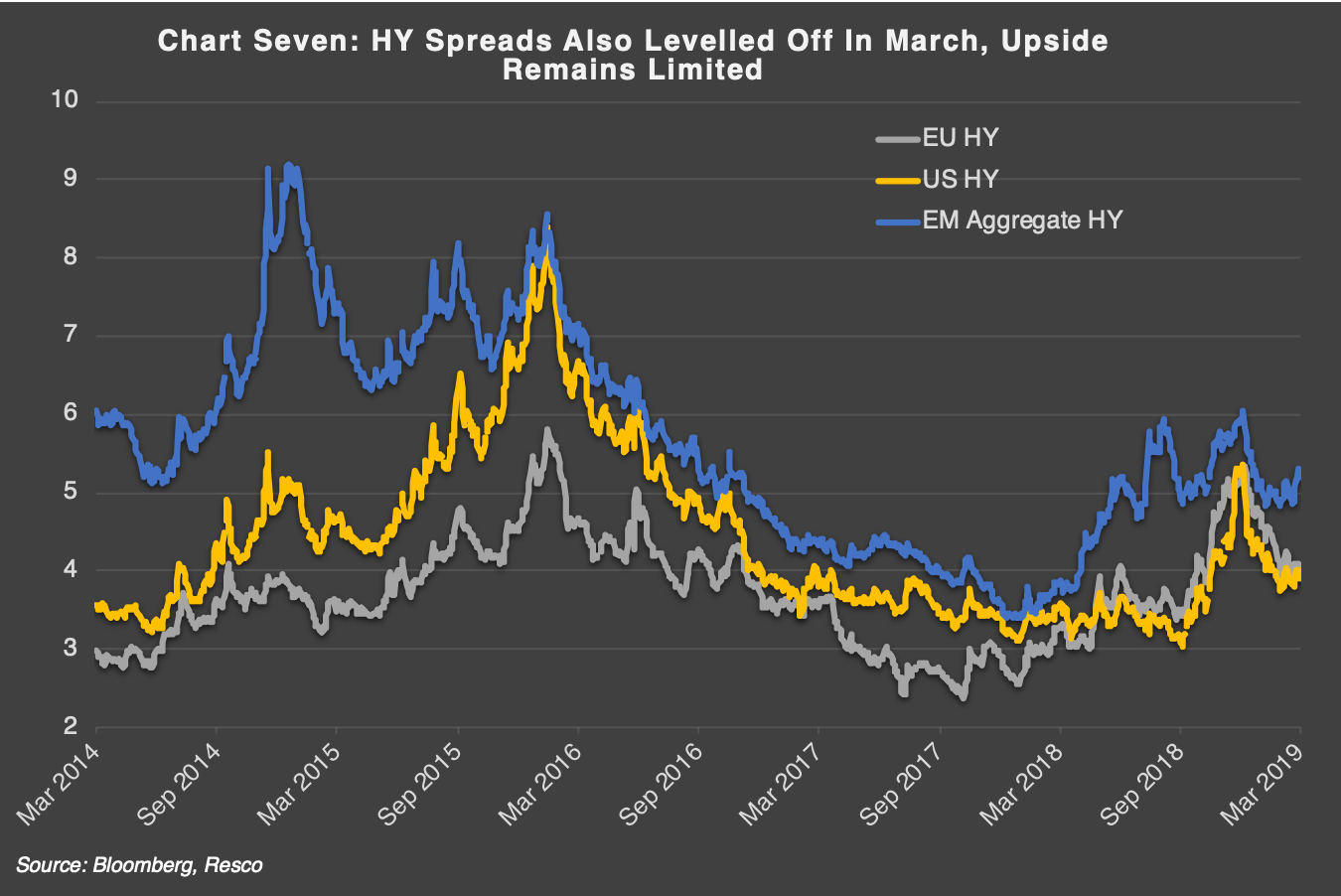

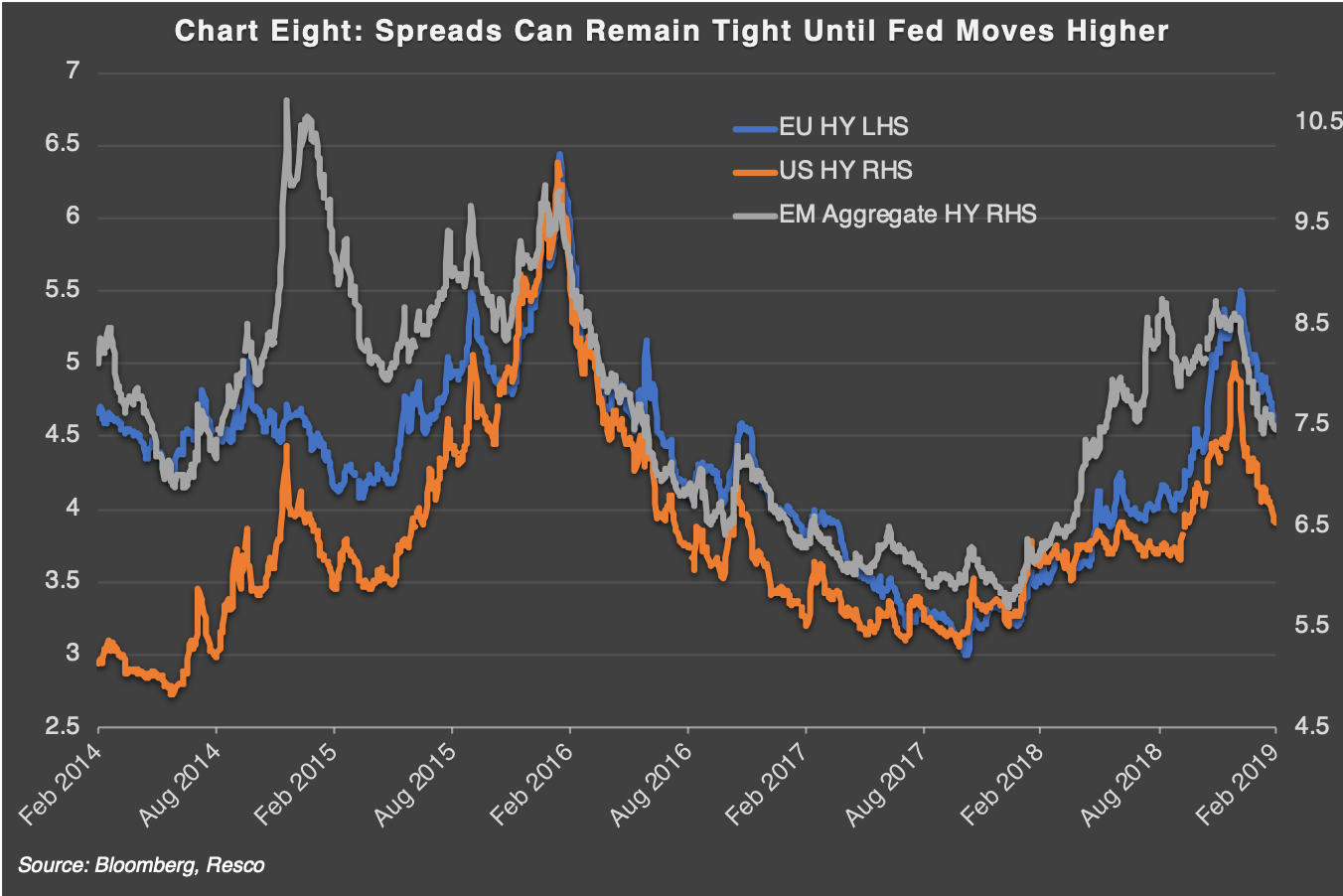

As it stands, spreads remain settled in October 2018 territory, with US IG spreads ever so slightly leading EUR IG, at around 120bps. High yield tells a similar story, with US HY spreads slightly wider and EUR HY spreads flat for the month.

As it stands, spreads remain settled in October 2018 territory, with US IG spreads ever so slightly leading EUR IG, at around 120bps. High yield tells a similar story, with US HY spreads slightly wider and EUR HY spreads flat for the month.

While the primary market tide continues to rise into the new quarter, the demand for bonds, driven by underinvested investors, many of whom have recently seen big inflows, appears very strong. In that context it is useful to keep in mind that investment grade spreads were as low as 75bps in Europe and 85bps in the US as recently as March 2018, so there is plenty of upside left for bulls & panic buyers alike to chase.

The short-term direction for fixed income is at the mercy of central banks, with data offering hope for upticks in volatility. In credit, investor flows are crucial as new entrants chase a limited pool of secondary market bonds, with the central bank put once again rendering fundamentals irrelevant, for the very short term. For example, it flew under the radar that in the first quarter of 2019, S&P ratings upgrades were outnumbered by downgrades by a measure of 2 to 1.

Our strategic entry points are some way from here and probably need a higher US rate complex to materialise. A reversal in recent risky asset performance could possibly see spreads retrace, but arguably the already-dovish tilt to central bank rhetoric globally (Chart Three) can keep the carry-hunters across the government and corporate spectrum happy for the near term.

Thank you for reading and don’t forget to comment, share and contact us for questions!