While some economists are tasked to provoke thought and have the freedom to publish perfectly valid theses only to have markets move against those views for years before awarding them validation, the judgement of a portfolio manager tends to observe 12-month absolute return cycles. Some portfolio managers have the risk appetite or the mandate to bet on the timing of an impending economic crisis, for example; others, however, must put their risk budgets to work tactically while remaining mindful that systemic themes may at some point find a wormhole to punch through and manifest. We are in the latter camp.

“Matters of great concern should be treated lightly. Matters of small concern should be treated seriously.” – Ghost Dog: The Way of the Samurai

Core Views

- US: Steepening bias while reduced overall long duration positioning after recent rally.

- Europe: Flattening with an overall short bias. Short positioning still focused on Italy.

- UK: Gilts are a short in most Brexit scenarios, close to 1% is a longer-term entry point. Remain tactical with heightened political noise.

- FX: Trading tactically MXN and JPY. Strategically looking to be short USD vs both EM and pro-cyclical DM currencies.

- Credit: Mismatch between inflows & primary market issuance remains dominant theme, subordinated banks continue to offer value.

- EUR & US HY: Little difference in US vs. EU spreads. Spreads remain too tight for broad allocation, sole focus on high-conviction single name.

Glancing back at Master Ittei’s words, in the current day environment it is the matters of small concern that require serious focus in order to maintain positive returns. Trade wars, central bank sentiment and short-term fluctuations in data are often treated as ‘noise,’ and we would agree that this is an apt label. However, if we eyeball the spectrum ranging from noise to megatrends, it is the front end of that spectrum (tactical and strategic views reaching target gains or losses in less than six months) where our focus must be most intense. Why? If we were to saturate matters of ‘great concern’ with our resources, like global GDP growth and debt, the timing of when we are proven right or wrong would be totally out of our control, and we would be more at the mercy of the intensive time decay associated with trading against market momentum.

At times like this, one needs to respect the uncontrollable path of the market so not to lose focus on practical opportunities that can be timed and targeted. This brings us to another quote from the same film:

“It is a good viewpoint to see the world as a dream. When you have something like a nightmare, you will wake up and tell yourself that it was only a dream. It is said that the world we live in is not a bit different from this.” – Ghost Dog: The Way of the Samurai

Apart from those who practise lucid dreaming, we are not in control of our dreams and nightmares. Daily smoking guns published by 24-hour news manufacturers tell us why risk markets are doing what they are doing, but we can only ride the wave that we are served and use that momentum as a landscape for our portfolio management activity.

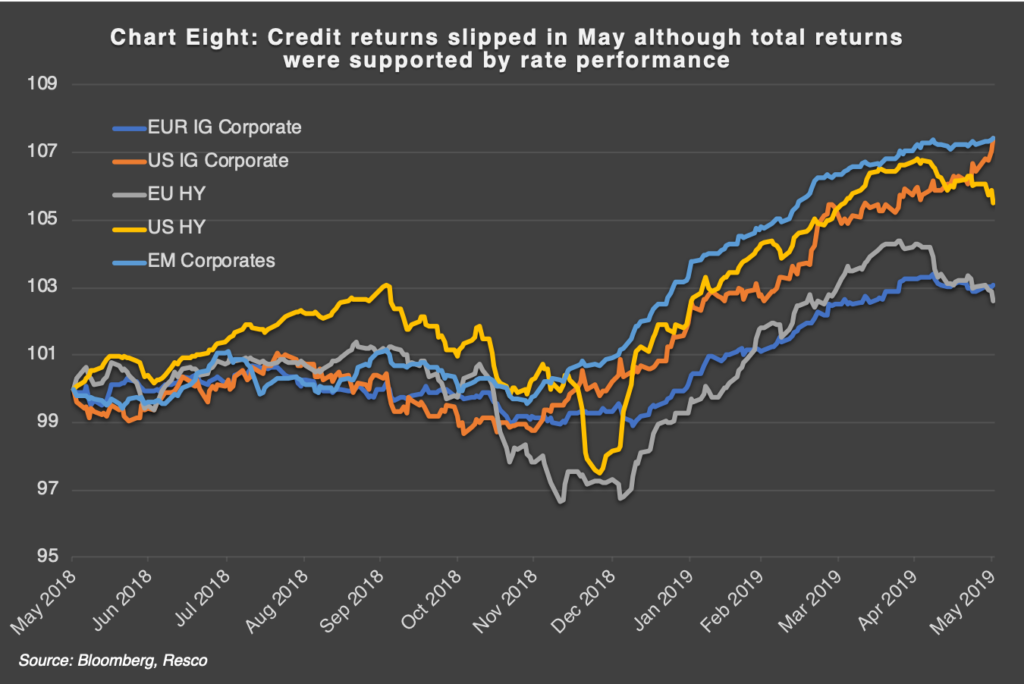

This year has been a good example of this. What turned out to be a one-way recovery from a volatile Q4 2018 suddenly turned into a patch of gloom for investors who shunned the “Sell in May and go away” strategy. So far, however, the old axiom seems to have worked like a dream, but some of you will know the full statement: “Sell in May and go away, and come back on St Leger’s Day,” falling around mid-September this year. The 4-6 month trend that the ‘Sell in May’ theory would like to see has been weak over the last 5-6 years; and if there is an observation to add to your already-filled list of May post mortem factoids, it would be that not one investing day felt truly panicky.

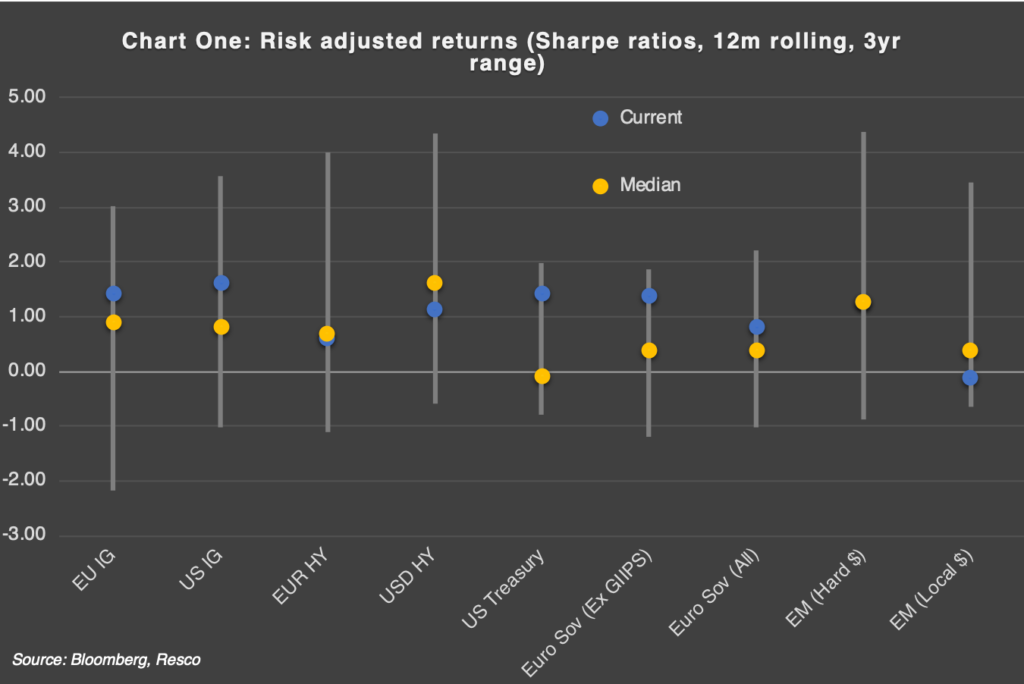

There was some sense of capitulation at May’s month-end, which started with further equity losses after another tariff twitter bomb hit, this time directed at Mexico. Some of the tremors transcended into implied market volatilities, especially in bond markets where we reached levels not seen since Q4 2018 (Chart One).

The absence of deeper corrections makes sense to us as, more recently, politically-induced setbacks turned out to be buying opportunities while markets price further possible macro implications, especially into the Fed’s reaction function. The previously relatively-small concern of the central bank’s dovish neutrality has now seemingly put the more worrying political rhetoric onto the back-burner for now, although they are obviously interlinked.

With short-dated futures now pricing a quicker and sooner rate cycle than a month-ago (2 more rate cuts by the end of 2020 and ~75 bps in total), an easing cycle seems imminent. The primary consideration for the upcoming June FOMC meeting is whether the recent evidence of downside risks and generally somewhat weaker economic data warrant an insurance rate cut. And if so, when?

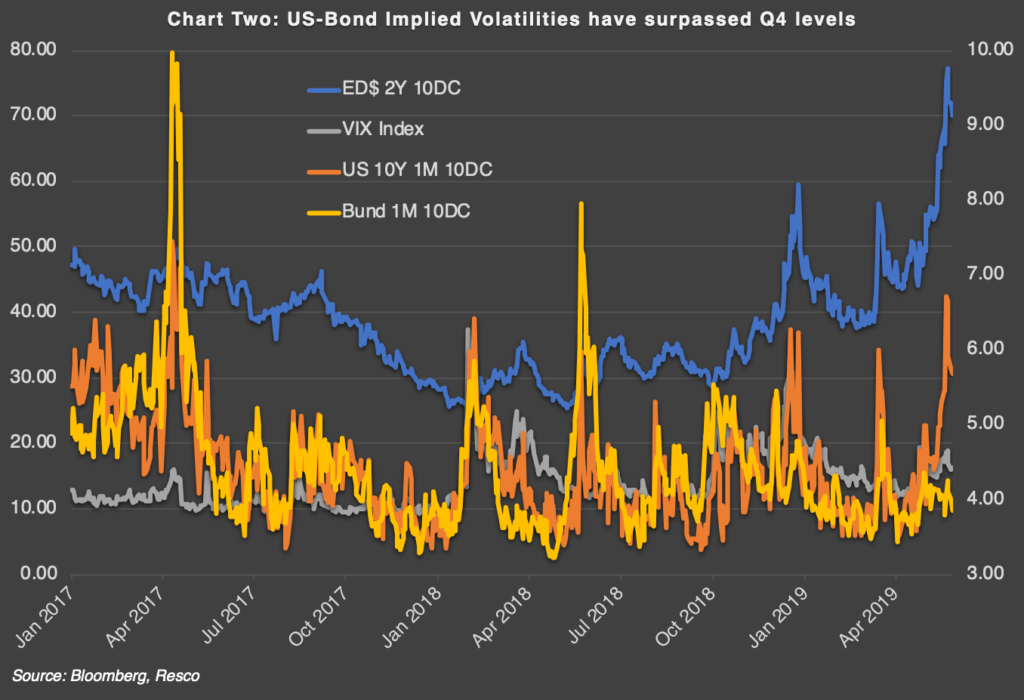

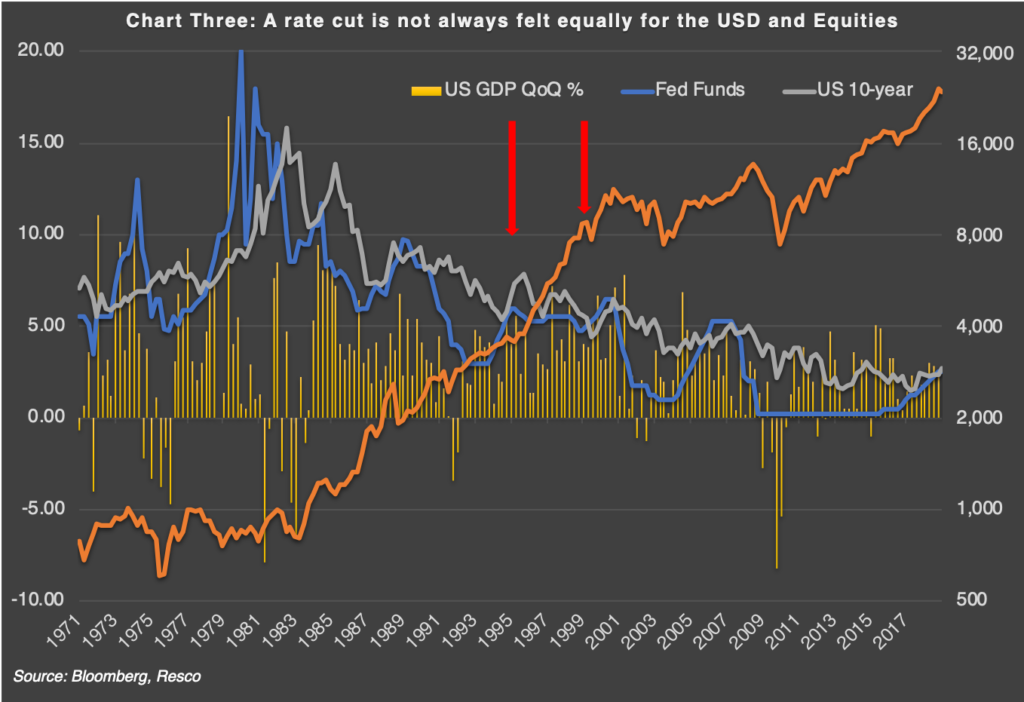

The implications for assets are dramatically different depending on whether any realised rate cuts would support growth and avoid a recessionary outcome. We find the parallels to 1995 and 1998 (Chart Two) where the Fed cut a cumulative of 75 bps on both occasions in relatively short time a useful starting point to analyse possible return paths going forward. If those episodes were repeated, risk markets would rally with both bond yields and the US Dollar heading lower.

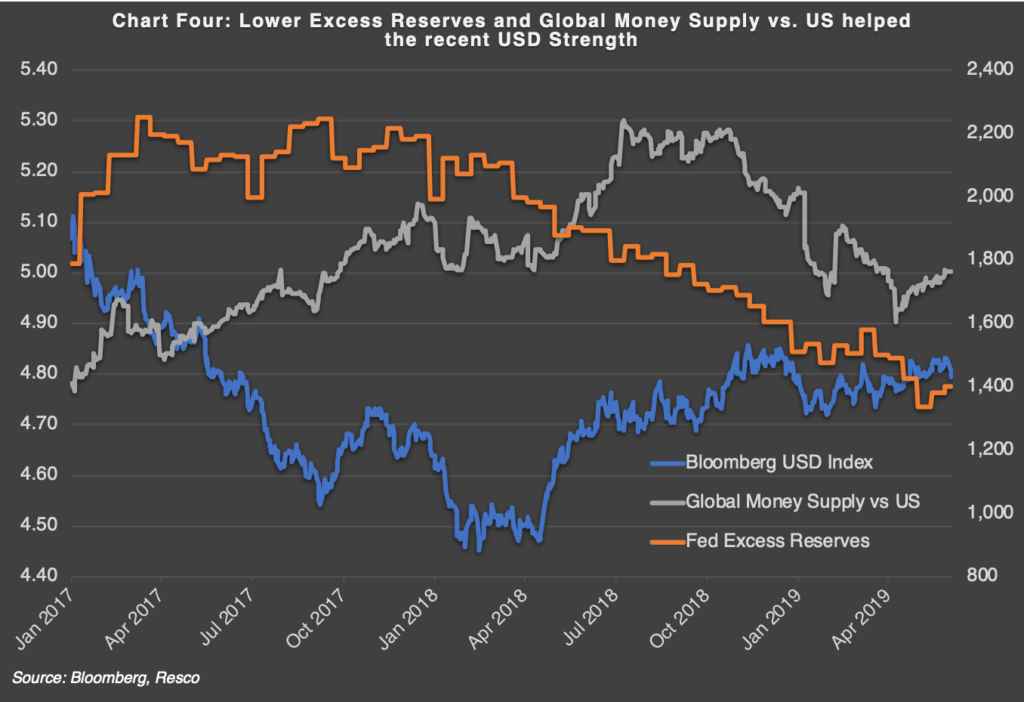

As such, we see a relatively positive backdrop for risk markets for the summer months ahead as economic data likely stabilises, while central banks stand ready to act if needed. As volatilities and political noise are hopefully reduced, current low rates will entice market participants again to add equity, credit and liquidity risks to their portfolios. In addition, a potentially-weakening US dollar would be a welcome monetary stimulus globally (Chart Three), which would further support risk assets.

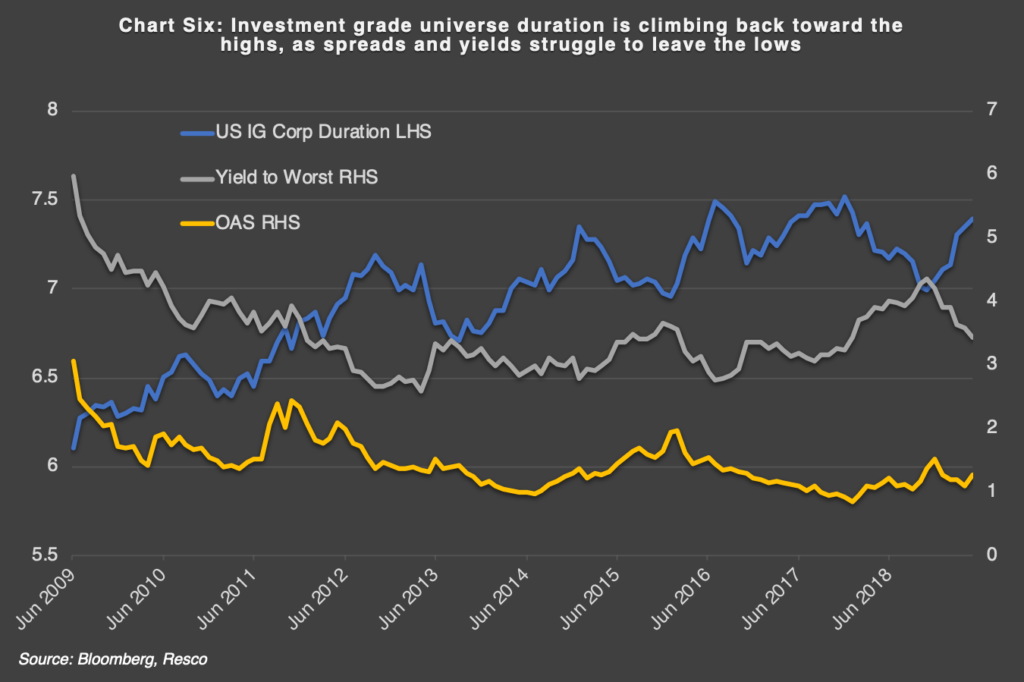

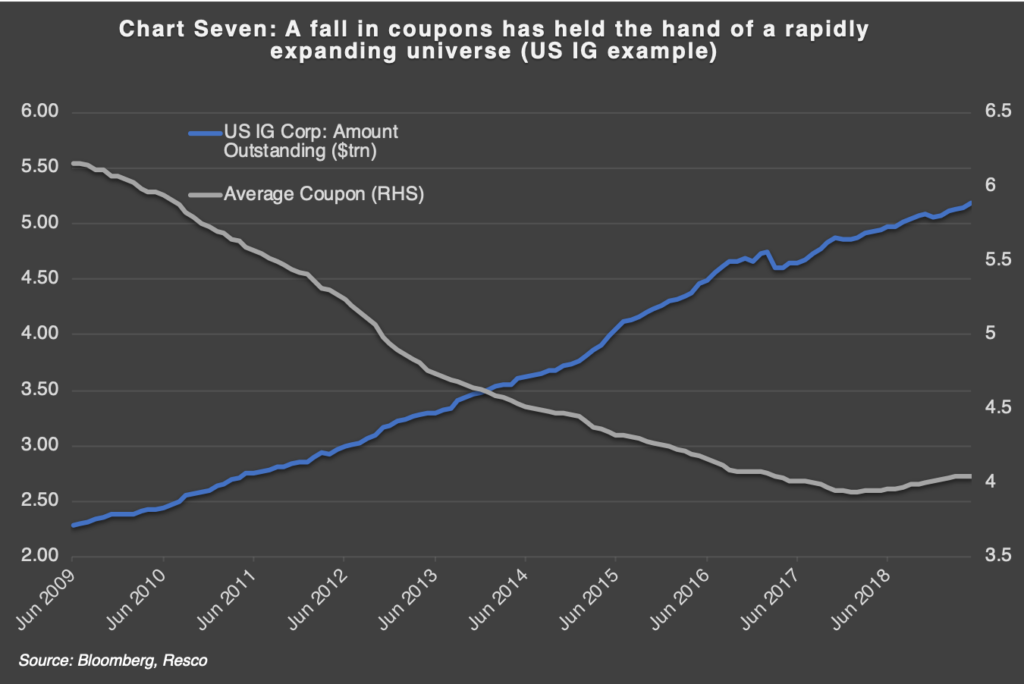

As yet we are not seeing a strong return to risk-on positioning. Credit investors are treading water, with limited volumes of corporate bonds changing hands in an orderly fashion in May, while the primary market again underwhelmed and slowed to a standstill as volatility picked up. Despite the return to lower bond yields, and thus reduced coupons for new bond issues, there has been only tentative signs for activity in the primary market in early June as risk markets stabilised. Government bond markets have already delivered rate cuts, but it will do little to stimulate broader economies if companies do not continue to take advantage of them.

Of course, one should not be entirely ignorant of those systemic concerns that being largely ignored by risk markets, and here we choose to create of a suite of structural contingency positions that will allow us to articulate our strategy’s reaction function to a shift away from the prevailing low-volatility environment. This strategic contingency process will be kept live, detailing precise shifts in risk units away from our short-term positioning and will be housed in our ‘quarterly compass’ strategic allocation tool, so not to be caught up in the false starts that we anticipate seeing every few months or so. The likely trigger for our first serious look at a portfolio shift would be when central bank policy aimed at cushioning decelerating growth falls short of what is needed (prompting action beyond QE and negative nominal interest rates) to avert recession, combined with moving averages in risk markets that signal deeper changes in investor behaviour than what we have seen in the last 10 years.

Thank you for reading and don’t forget to comment, share and contact us for questions – the Resco Team